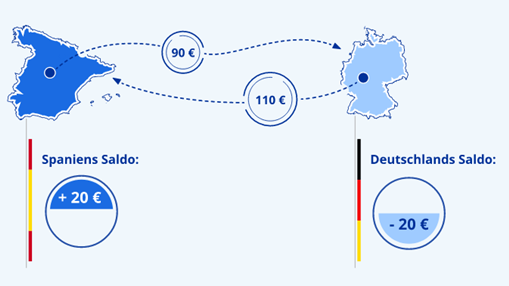

There Is No Normalization of Target Balances, Despite the Normalization of Monetary Policy

The ECB’s new monetary policy leaves one important question unanswered: Will a normalization of Target balances also follow, that is, will the problem of debt within the eurozone be solved as well? If not, a normalization of monetary policy will be impossible.