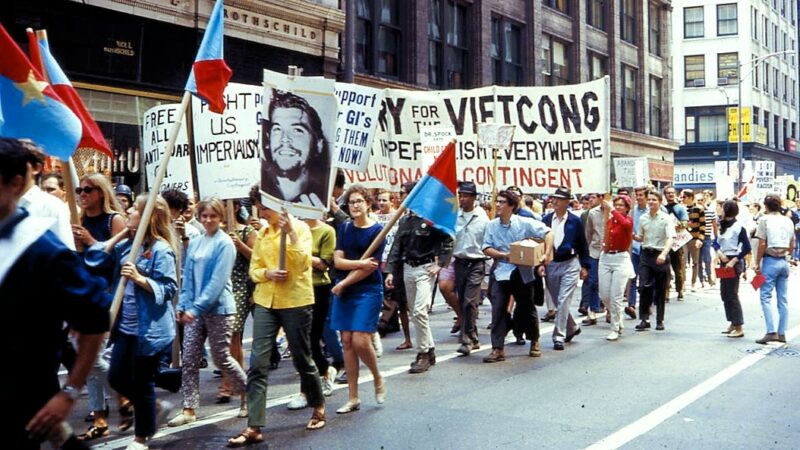

March 10, 2021: Senate Democratic Majority Leader Chuck Schumer, House Speaker Nancy Pelosi, and Democratic members of Congress at the enrollment ceremony for H.R. 1319, the “American Rescue Plan Act,” before it was signed by President Biden the following day. (Image: flickr / Senate Democrats)

March 10, 2021: Senate Democratic Majority Leader Chuck Schumer, House Speaker Nancy Pelosi, and Democratic members of Congress at the enrollment ceremony for H.R. 1319, the “American Rescue Plan Act,” before it was signed by President Biden the following day. (Image: flickr / Senate Democrats) Major societal changes usually take place imperceptibly, building up slowly over time. Today, however, we are witnessing a shakeup in Europe and the United States that has changed the economy and society in a matter of months—but unfortunately not for the better.

This is because, with unprecedented spending packages, the governments are taking over a large part of the national economy, the central banks are printing the money for it, and the politicians are distributing this money directly to households.

The politicians waste the money, but they do not waste a thought on how much this will cost in interest, or how it will be paid back one day.

In the USA, the victorious Democrats approved a preliminary program of $1.9 trillion, which is already in full force (the “American Rescue Plan”). The next one has been announced and will provide $2.2 trillion for infrastructure. The Republican government, however, already coughed up the same amount last year, almost $4 trillion through five programs (including “CARES”). And further $1.8 trillions are to come, says Biden. It feels like being transported to Scrooge McDuck’s books, with his “obsquatumatillions” in the safe.

Here, however, we are not talking about treasures, but expenditures and new debts.

These figures have become unimaginable, even for the politicians themselves, otherwise they would not pass them. We are a long way from everyday life in a bakery, where the entire income must be earned at the counter in chunks with “one euro please,” and “that makes three euros and fifty.”

Unimaginable Sums at the Wrong Time

To put these sums in perspective, compare them with the current gross domestic product (GDP). The U.S. national debt accumulated to date stands at 130% of GDP, and the Federal Reserve estimates that in four years it will be 191%. That is well above what caused panic over Greece’s solvency a decade ago. Current spending by the U.S. federal government is a staggering 35% of the economy this year, and as a share of GDP about 20% is financed with new debt. This is because the deficit of such a prodigal state accounts for 55% of its expenditures, and it will be two-thirds of it in four years. You can look at this—and then lie awake at night—in the official number ticker of the U.S. Debt Clock.

This brings us to the assessment of this frenzy. First, the government is massively pushing up expenditure flows in the economy, ordering enormous services, and pouring loads of money into households. And this at a time when the national economy is picking up as never before. Unemployment is no longer increasing, retail trade is exploding, corporate profits are rising massively, and industry is picking up by leaps and bounds. In addition, households, and not just the richest, have saved about as much extra because of the COVID relief measures as the $1.9 trillion package has added. That money is now starting to roll in, too.

This spending binge under Biden has a “procyclical” effect—it is unnecessarily turning up the economic cycle that is already underway.

Lawrence Summers, the former—Democratic—Treasury Secretary under President Clinton, says what this means: this spending binge under Biden is having a “procyclical” effect—it is unnecessarily accelerating the economic cycle that is already underway. Many companies are now reporting rising costs, and are beginning to pass them on to consumers, like Procter & Gamble with markups of up to 12%. But the magic word used by the devotees of stimulus economist John M. Keynes is precisely “stimulus”: they admit that they no longer trust the economy for its proven self-healing powers. This is new in the West.

COVID as an Excuse for a Spending Frenzy—And Wall Street Booms

But the changing times are evident in how the money is being spent. Money for the unemployed, who the U.S. welfare system otherwise bails out cheaply, has been (rightly) increased, but that accounts for the smallest part. The Biden package of $1.9 trillion renovates schools, helps already over-indebted individual states, and distributes the largest single amount in cash to households, without proof of need.

The coming infrastructure package has nothing to do with the COVID crisis; it is about highways for $621 billion, about housing, about industrial subsidies of no less than $300 billion, and $180 billion for research and development. In the future, state bodies will say what is produced and how, and what is researched. The ideal motivation, the excuse for this $2.2 trillion will now be a green, “sustainable” society instead of the COVID crisis.

And once again, the Democrats are fueling even more income and wealth concentration—Wall Street is booming with joy, and with big money to be made in shares of all kinds of energy, in cement, hydrogen…

A Waste of Money—with Devastating Consequences for All

Second, these incredible sums are ultimately “financed” with the printing press—also a novelty in recent economic history. Both central banks, the American and the European central bank, announced in March of 2020 that they would buy up the increased government spending due to COVID in the form of the new debt securities issued for this purpose—and in both currency areas, politicians began to put together spending packages within days. In the meantime, however, they have long since exceeded the pandemic-related spending, as mentioned above, so that every spending wish seems to be fulfilled by printing money.

The politicians waste the money, but they do not waste a thought on how much this will cost in interest or how it will be paid back one day. There is vague talking about future taxes in US and in EU, but economists do not yet believe it and see massive evasion. Because the central banks have lowered the interest rates to or below zero, the state has reinvented the wishing-table for itself. Greece just had no independent currency in order to use the printing press to make the debt load become “forgotten,” like the USA does, by simply printing money, for debts and for interest. Greece had to undergo enormous austerity measures by order of the EU—and because the ECB threatened to cut off “emergency liquidity assistance.”

But if inflation picks up, then, the central bank says, it will tolerate it briefly, but then fight it using its available means. These means, however, would put an end to the “new era” that had been announced—higher interest rates and no new money in circulation would bring bankruptcy to almost all states, to many companies, to homeowners far and wide, and would end the stock market boom, with devastating consequences for pension funds, insurance companies, and private individuals. The cowards at the central banks, which have been turning on the money tap since 2009 in the event of even the smallest problems, will therefore never, ever use “their funds” once they have reached the dead end. The share of government spending, government deficits, and government debt in the domestic product presented at the beginning will simply no longer allow it.

Universal Basic Income through the Back Door

The third element of the turnaround is embodied in direct payments to households, unconditionally, without proof of need. The Biden package pays adults with $1,400 up to a single income of $75,000 and $150,000 for a couple. These are already princely proportions—especially in the U.S. —and clearly the “stimulus” is not social policy. But as surveys show, they, even lower classes, will not spend the “stimulus” but save it and at best throw it into the stock market. After all, the mountain of spontaneously saved money during the pandemic is already waiting to be spent. That is enough for most. The approximately $500 billion in new state debts for unnecessary private expenditures flow these days now directly from the printing press into the household accounts.

The dams to universal basic income, by means of the printing press, have burst. The idea is already repeating itself—the 2020 Republican packages already paid out $1,200 directly. Some politicians already think the state could move to regular distributions, since they seem to cost nothing. Income for all without any endeavor: the end to the market economy and all its incentives.

A New Era: States and Politicians in a Spending Frenzy

Unbelievable national debts and deficits, direct access of politicians to the printing press, and unconditional payments to citizens: this radical novelty will not be remedied even with the few corporate taxes intended by President Biden. The EU, for its part, is embarking on the path of massive new public debt of 1.75 trillion euros: that is, its own EU debt, forbidden by the treaties.

Unfortunately, only in Italy will there be a repeat of what happened with the last $80 billion aid there: only 6.7% was actually spent, because the country is even incapable of spending money. In the USA and other European countries, on the other hand, the state will spend the sums in full, either for itself, or more and more often through contracted agencies, special budgets, companies, and consultants. The state is not only squandering money and risking its inflationary devaluation, it is also squandering its legal and political structures. A new era has begun, before our eyes, and within a matter of months.