Socially Unjust Inflation: Why Recessions Are Inevitable and Salutary

Inflation is profoundly socially unjust. Its causes lie above all in an expansionary monetary policy, and this must be stopped. If policymakers want to prevent the inevitable recession that will follow, they will only make the problems worse.

The Inflation Problem: Short-, Medium- and Long-Term Solutions

In principle, it is the task of central banks to anticipate and combat inflationary risks. But since central banks failed to recognize inflationary pressures for a long time and then downplayed them as temporary, they can no longer contain inflation in a hurry. What solutions are feasible?

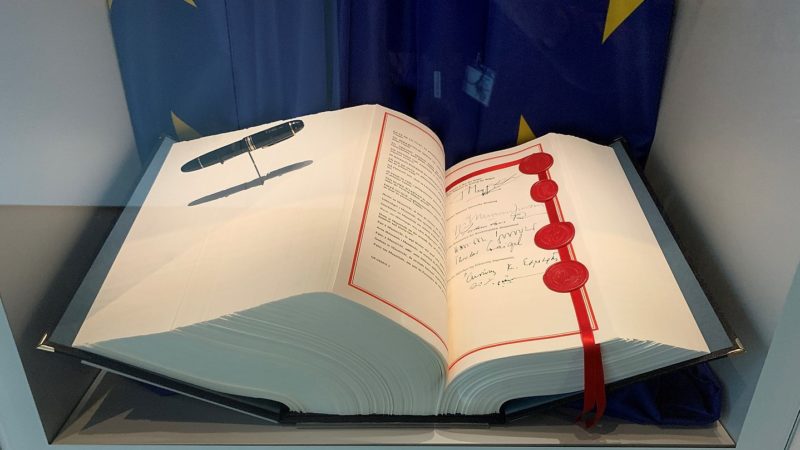

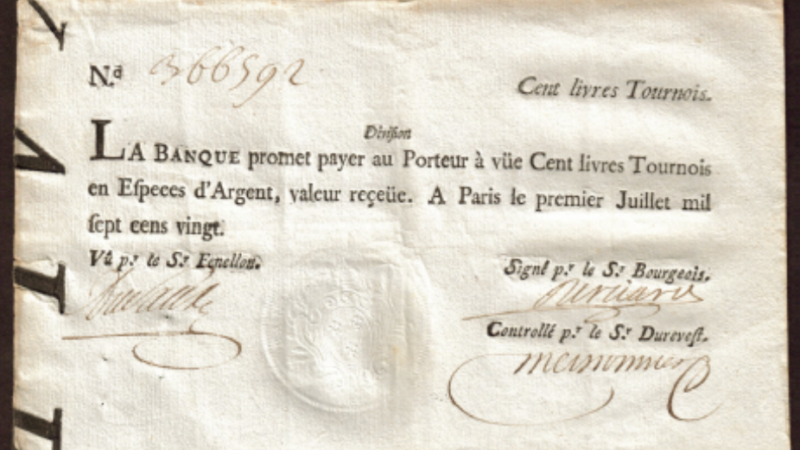

The Governments Were Financed Through by the Printing Press, And Now We Have Inflation

The rise in inflation does not fall from the sky. Inflation means general devaluation of money, not an increase in individual prices. It is the result of the money glut of the last several decades. Avoiding the dramatic consequences could make things uncomfortable.

What Does the Coronavirus Crisis Teach Us about the Labor Market?

The Covid-19 crisis threw many out of work, many suffered accordingly, and labor markets were also damaged. Depending on the situation, some governments fared better than others. In any case, policymakers can learn a few things from the pandemic.

Low Interest Rate Policy Cripples the Economy and Reduces Prosperity

Japan’s low interest rate policy began 30 years ago, about 15 years earlier than in the EU. But three decades of low interest rate policy meant three lost decades for Japan. In an interview with Stefan Beig, economist Gunther Schnabl explains why the low interest rate policy is so damaging to prosperity.