Delusions of Omnipotence and Shifting Backdrops: USA and EU Launch Giant Industrial Policy Programs

The USA and the EU have recently been in a subsidy race—industrial policy by bureaucrats. The innovative forces of the market are being undermined and the inefficiency of these measures is predictable.

“Doux Commerce,” or the Peacemaking Power of Trade: Just a Dangerous Illusion?

Does trade among nations promote peace? The liberal-minded Enlightenment affirmed this under the phrase “doux commerce.” At present, however, we are witnessing how economically closely linked nations are at war with each other.

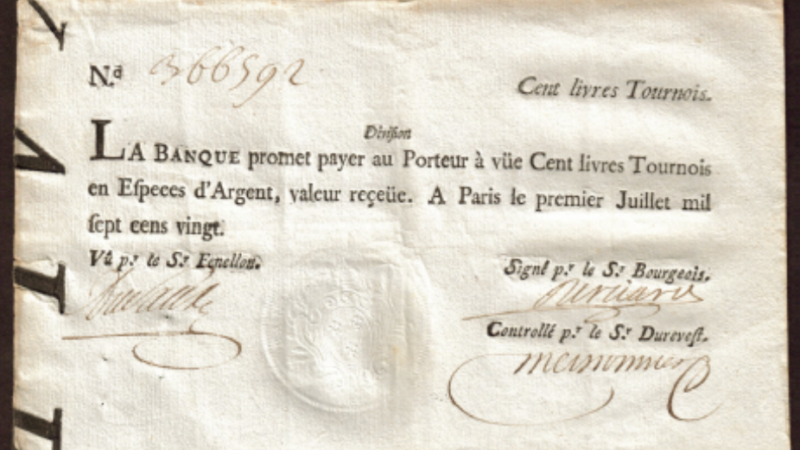

The Governments Were Financed Through by the Printing Press, And Now We Have Inflation

The rise in inflation does not fall from the sky. Inflation means general devaluation of money, not an increase in individual prices. It is the result of the money glut of the last several decades. Avoiding the dramatic consequences could make things uncomfortable.

The Earned Income Tax Credit (EITC)—The Best Social Program in the World

Economists and researchers in the U.S. agree: the Earned Income Tax Credit helps millions of households stand on their own two feet. Work is rewarded, and with the help of this program, one million children have escaped child poverty.

What Does the Coronavirus Crisis Teach Us about the Labor Market?

The Covid-19 crisis threw many out of work, many suffered accordingly, and labor markets were also damaged. Depending on the situation, some governments fared better than others. In any case, policymakers can learn a few things from the pandemic.

Private Currencies Terrify the Central Banks

Private currencies are currently making central banks sweat. The flood of paper money is making alternative private currencies increasingly attractive. They are based on a technology that is almost unassailable, and the central banks are reacting as you would expect.

European Infrastructure and Tech Policy: Failures, Breakdowns, and Empty Promises

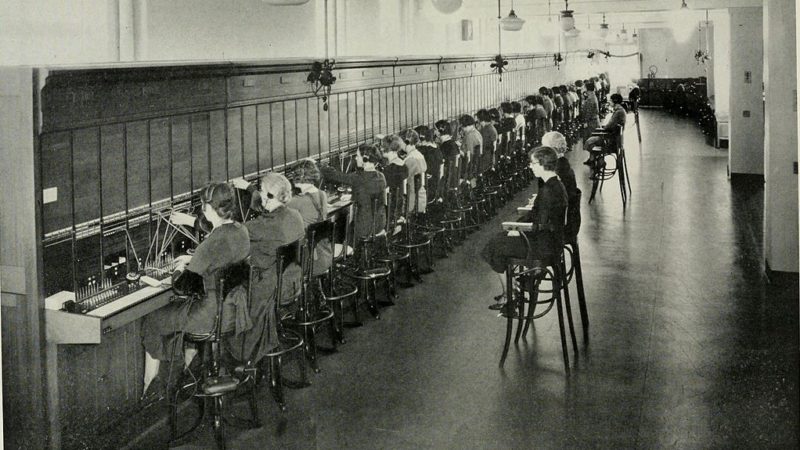

Compared to the USA, Europe is lagging behind in terms of information and communications infrastructure. A reexamination reveals: For too long, billions of taxpayers’ money have been invested in technologies of the past.

A New Era: Politicians and Central Banks Reinvent the Wishing-Table

Unbelievable national debts and deficits, direct access of politicians to the printing press and unconditional payments to citizens in the USA. The EU, for its part, is embarking on the path of massive new national debt. Can this possibly end well?

No More Growth—And Happiness Is Just Around The Corner

Critics of growth call for zero growth or even “degrowth”. Their fears are based on economic misconceptions and a failure to recognize the capitalist dynamic of decoupling growth from resource consumption. Moreover, they fail to recognize the needs of poor countries.

Thinking Economically: Only the Market and the Logic of Exchange Create Prosperity

Economics is not a zero-sum game. In exchange, both sides always benefit. Exchange is the soul of the market and creates added value, and does so in a way that benefits everyone involved. A plea for economic enlightenment.