Socially Unjust Inflation: Why Recessions Are Inevitable and Salutary

Inflation is profoundly socially unjust. Its causes lie above all in an expansionary monetary policy, and this must be stopped. If policymakers want to prevent the inevitable recession that will follow, they will only make the problems worse.

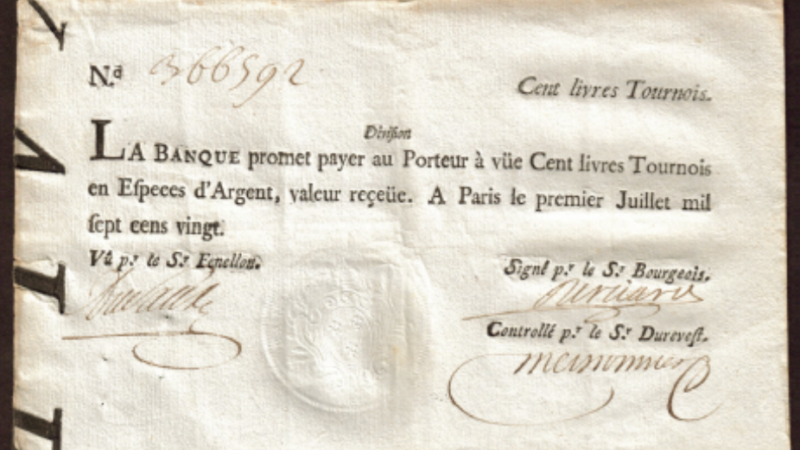

Private Currencies Terrify the Central Banks

Private currencies are currently making central banks sweat. The flood of paper money is making alternative private currencies increasingly attractive. They are based on a technology that is almost unassailable, and the central banks are reacting as you would expect.

Low Interest Rate Policy Cripples the Economy and Reduces Prosperity

Japan’s low interest rate policy began 30 years ago, about 15 years earlier than in the EU. But three decades of low interest rate policy meant three lost decades for Japan. In an interview with Stefan Beig, economist Gunther Schnabl explains why the low interest rate policy is so damaging to prosperity.

A New Era: Politicians and Central Banks Reinvent the Wishing-Table

Unbelievable national debts and deficits, direct access of politicians to the printing press and unconditional payments to citizens in the USA. The EU, for its part, is embarking on the path of massive new national debt. Can this possibly end well?

The Discovery of “Capital” in the Economic Ethics of the High Middle Ages

The pioneers of modern economics were moral theologians of the Middle Ages. Petrus Johannis Olivi discovered, among other things, “capital,” the subjective theory of value, and distinguished interest from usury. He thus paved the way for a positive view of commercial activity.

Money Glut, Debt, and Rolling Central Bank Guarantees: Full Steam Ahead towards the Abyss

Central banks have become prisoners of their own policies with their perpetual monetary glut. Everyone knows this, and everyone knows that everyone knows it. But proclaiming a different message, they shirk responsibility. The party must go on at all costs.