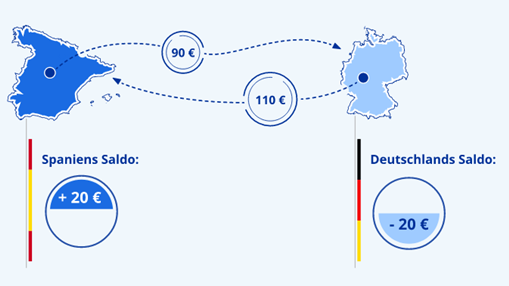

Over time, accumulated money flows between sovereign nations and the ECB generate TARGET2 balances (Image: ECB)

Over time, accumulated money flows between sovereign nations and the ECB generate TARGET2 balances (Image: ECB) 1. The Monetary Policy Environment for Target Balances Is Changing

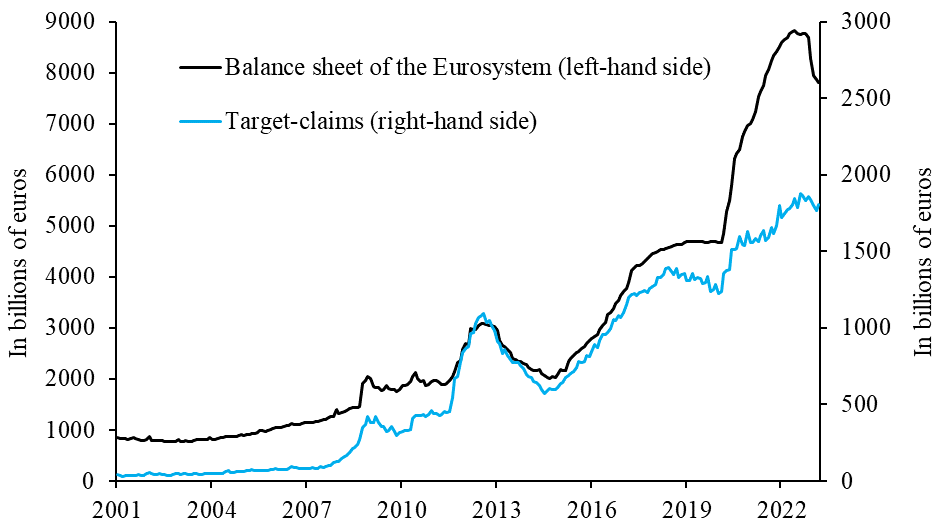

With inflation remaining high, the European Central Bank (ECB) has been tightening its monetary policy since June 2022. The key interest rate (main refinancing rate) has risen to 4.0%, and the ECB’s balance sheet volume is shrinking. With inflation in the eurozone still at 5.5% (June 2023), further rate hikes are expected. This could also be followed by a normalization of the so-called Target balances: the claims and liabilities of European national banks in relation to the European Central Bank, which arise from transnational payments settled in central bank money. These were created in the wake of the European financial and debt crisis on the heels of a rapidly growing central bank balance sheet (fig. 1).

Figure 1: The Eurosystem Balance Sheet and the Total Volume of Target Claims

At present, for example, Deutsche Bundesbank claims on the ECB totaling around 1.1 trillion euros are offset by liabilities of the Banca d’Italia to the ECB totaling around 700 billion euros. The total volume of Target imbalances is around 1.8 trillion euros. Hans-Werner Sinn (2020) has called the Target balances a trap. The Deutsche Bundesbank cannot simply collect its claims on the ECB. According to Sinn (2018), these claims would be worthless if the euro project were terminated. There could then be a huge gap in the Bundesbank’s balance sheet, as the Target claims are far larger than the Bundesbank’s share of capital and reserves (€5.5 billion). A reduction in Target imbalances would be desirable from this perspective, but that is not expected any time soon.

2. How Did the Target Imbalances Come About?

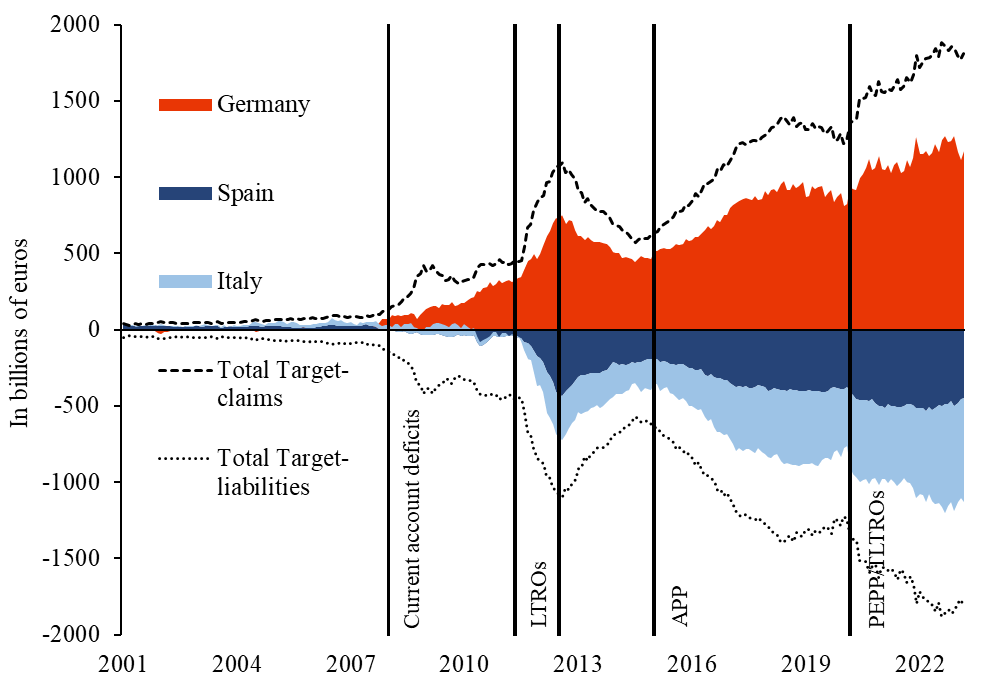

The Target imbalances came about in 2008 during the European financial and debt crisis and the additional crises that followed. Growing liabilities of some central banks of the southern euro states—for example, the Banca d’Italia—were matched by growing claims of the central banks of some northern euro states, in particular the Deutsche Bundesbank (Fig. 2). The Target system, which primarily serves to settle payment flows, evolved into a kind of credit system that has been instrumental in stabilizing the eurozone since 2008.

Before the crisis, some southern euro countries such as Greece and Spain had imported more than they exported, that is, they had current account deficits thanks to substantial loans from the north. Since the loans from Germany were not invested but mainly consumed, confidence in these countries’ creditworthiness declined. Lending stopped, and the crisis took its course.

As the crisis countries initially continued to run current account deficits, and financing via bank loans from the northern euro area failed to materialize, the deficits were financed within the Target system via loans from the ECB. These were then passed on to Italian banks via (for example) the Banca d’Italia. Germany, where payments for export earnings continued to be received, saw the growth of deposits with banks, deposits of banks with the Deutsche Bundesbank, and claims of the Bundesbank on the ECB within the Target system.

Although current account deficits declined, a flight of capital from the southern euro countries set in. For example, Italian investors increasingly withdrew deposits from Italian banks and placed them in German banks. As the lack of liquidity at Italian banks was replenished with the help of loans from the ECB (longer-term refinancing operations, or LTROs) to the Banca d’Italia, the Banca d’Italia’s Target liabilities and the Deutsche Bundesbank’s Target claims on the ECB continued to grow.

After the longer-term refinancing operations expired and Target imbalances thus declined, the European debt crisis ensued. As capital outflows continued and risk premiums on the interest rates of the sovereign bonds of the southern euro states grew dramatically, the then ECB President Mario Draghi was forced at the height of the crisis to announce that he would do whatever was necessary to save the euro.

Figure 2: Target Balances of the Eurosystem

As a result, the Eurosystem purchased bonds (especially government bonds) on a large scale under the Asset Purchase Program (APP) from 2015 onward, with national central banks purchasing only government bonds issued by their home country. A large proportion of the bonds of the southern euro states were held by German banks or foreign banks with accounts at the Deutsche Bundesbank. Therefore, many proceeds from the sales of Italian government bonds to the Banca d’Italia were credited to accounts at the Deutsche Bundesbank. The credits were financed with Target liabilities of the Banca d’Italia vis-à-vis the ECB, and the Target claims of the Deutsche Bundesbank increased. The fact that the sales proceeds remained predominantly in the north of the euro area can also be viewed as capital flight from the south.

During the COVID-19 crisis, the ECB again significantly exacerbated Target imbalances with new bond purchases and new rescue loans. The Pandemic Emergency Purchase Program (PEPP) had a volume of 1.85 trillion euro, and the targeted longer-term refinancing loans (GLRGs) had a volume of around 2.2 trillion euro.

3. Why Target Imbalances are Unlikely to Decline Significantly

All three factors that have contributed to an increase in Target imbalances in the past no longer apply, since June 2022 at the latest, with the tightening of the ECB’s monetary policy.

The southern euro countries have not had any significant current account deficits for quite some time because they were pushed into austerity by the EU. (Italy even achieved considerable current account surpluses.) Banks have been rapidly repaying targeted longer-term refinancing loans since October 2022 because the ECB has discontinued their negative interest rates. Since April, the ECB has been reducing its bond holdings, which at their peak had reached a volume of around 4 trillion euros. Nevertheless, the risks posed to the Deutsche Bundesbank by the buildup of Target claims are unlikely to diminish significantly for three reasons.

First, Target imbalances would decline if capital flight were reversed, that is, if private capital flowed from the North to the South again. Deposits with German banks, and thus the Bundesbank’s deposits with the ECB, would decline. The deposits of Italian banks and thus the liabilities of the Banca d’Italia at the ECB would decline accordingly. But this would only be the case if interest rates in southern countries were to rise relative to northern countries such as Germany, or if a significant improvement in the economic situation were to make these countries attractive to investors.

But sharply rising interest rates would almost certainly destabilize highly indebted euro countries such as Italy or Spain because the countries’ interest obligations would rise. Many companies would come under pressure because the economy would weaken and financing costs would rise. Italian banks, which hold many Italian government bonds, would have to bear significant valuation losses on their balance sheets. Similar to the case of the U.S. Silicon Valley Bank, this could lead to a sudden withdrawal of deposits.

Probably also because of the high risk of a financial, debt, and economic crisis in the South if interest rates rise too sharply, the ECB intends to reduce its bond holdings only very slowly—currently at a rate of 15 billion euro per month under the APP purchase program. The volume of the PEPP bond purchase program, on the other hand, is to be kept constant until at least the end of 2024.

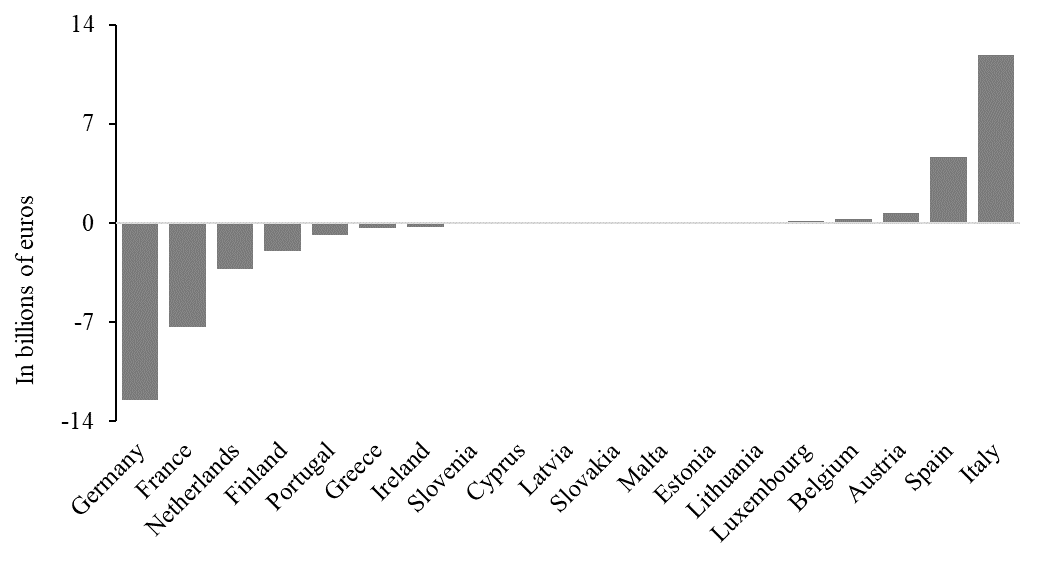

Maturing bonds, however, are to be redeployed in favor of countries with high debt levels. From April 2022 to May 2023, the Eurosystem increased its net holdings of Italian government bonds by €11.9 billion and of Spanish government bonds by €4.6 billion, while it reduced its holdings of German government bonds by €12.5 billion (fig. 3).[1] The renewed purchase of Italian government bonds by the Banca d’Italia is again likely to be associated with an increase in the Banca d’Italia’s Target liabilities and thus an increase in the Deutsche Bundesbank’s claims, but the size is limited.

Figure 3: Government bond reallocations within PEPP

The ECB (2022) has also announced the so-called transmission protection instrument, with which it can—under certain conditions—exclusively purchase bonds of over-indebted euro states to counteract a deterioration in financing conditions. As this will prevent increased capital flight from the highly indebted southern euro countries without having to activate the protection instrument, it will not only prevent a new debt crisis in the eurozone, but also a further increase in Target imbalances through the resumption of large-scale government bond purchases.

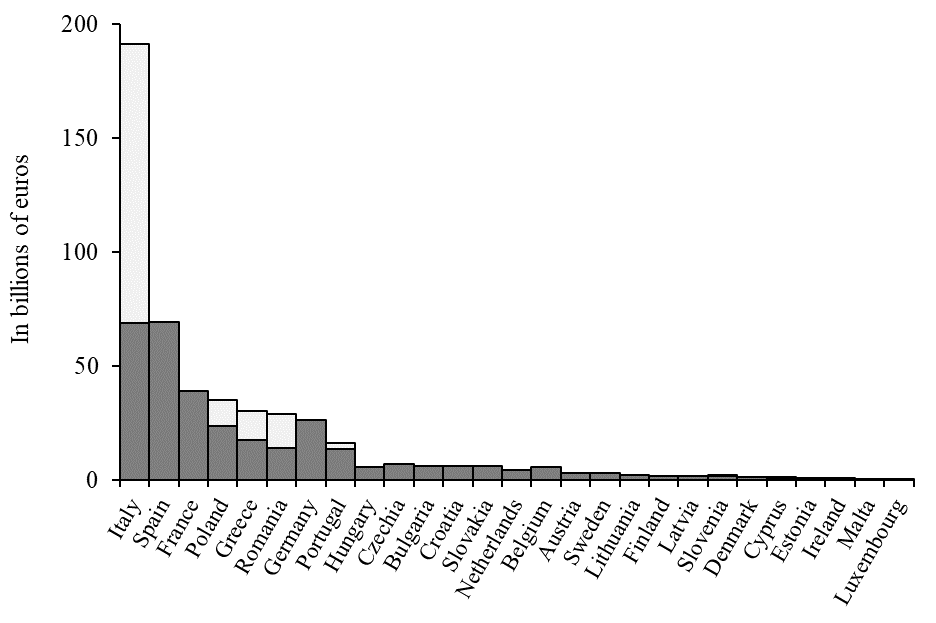

Second, in the wake of the COVID-19 crisis, the EU has ensured that economically fragile countries like Italy and Spain are given financial assistance.

Under the NextGenerationEU reconstruction and resilience plan, worth 807 billion euros, extensive financial aid will be made available over the 2022–2026 period. Italy will receive 191 billion euros, of which 69 billion euros will be grants and 122 billion euros will be loans (Fig. 4). Many German investors have bought the EU bonds issued for this purpose, while the EU is transferring the proceeds from the issued bond disproportionately to Italy and Spain. This creates a capital inflow to Italy that dampens the rise in Target liabilities (Drott et al. 2022). But this mitigates reform pressures in Italy, which lowers the likelihood of private capital inflows.

Figure 4: Country Breakdown of NextGenerationEU

Third, the Target balances bear interest at the ECB’s main refinancing rate. This was zero until July 2022, but is now 3.75 percent. The Banca d’Italia is thus estimated to have to pay around 23 billion euro to the ECB in 2023, while the Deutsche Bundesbank will receive around 40 billion euro. As these payments will be booked via the Target system, this corresponds to an increase in the Target liabilities of the Banca d’Italia and an increase in the Target receivables of the Deutsche Bundesbank.

4. Continuation of the Monetary Policy Exit Is Uncertain

Not least because of the comparatively small changes working in opposite directions, the potential to reduce Target imbalances via a normalization of monetary policy is currently limited. This is also true because reforms in the South, which could attract more private capital in the long run, are likely to remain absent in light of the extensive aid measures (transmission protection instrument, NextGenerationEU).

From the perspective of citizens in Germany, this means that nothing can make up for the consumption sacrifices made in the past to enable the export of capital. On the other hand, if the Target balances remain largely constant, no further consumption sacrifices will be necessary.

Further, the fact that the ECB and the EU apparently want to prevent a sharp rise in interest rates in the southern eurozone is more thought-provoking. Interest rate hikes would force governments in the southern eurozone to consolidate their public spending. Companies would have to make their production more efficient. Growth in the south would be revived, and capital would flow in.

But the necessary reforms seem politically undesirable. The non-normalization of Target balances could therefore even signal that a determined normalization of monetary policy in the eurozone is not possible. The ECB’s monetary tightening policy could soon come to an end.

Note

[1] The ECB has thus abandoned its principle of purchasing the government bonds of different euro countries in proportion to the share of these countries in the ECB’s capital key.

References

Drott, Constantin / Mitzlaff, Stefan / Paulick, Jan (2022): Warum die Corona-bedingten Fiskalmaßnahmen der Europäischen Union die TARGET2-Salden dämpfen. ifo Schnelldienst 75, 1/2022, 35-41.

ECB (2022): The Transmission Protection Instrument, Frankfurt.

Sinn, Hans-Werner (2018): Fast 1000 Milliarden Target-Forderungen der Bundesbank: Was steckt dahinter? ifo Schnelldienst 71, 14/2018, 26-37.

Sinn, Hans-Werner (2020): The Economics of Target Balances: From Lehman to Corona. Palgrave Macmillan.