Delusions of Omnipotence and Shifting Backdrops: USA and EU Launch Giant Industrial Policy Programs

The USA and the EU have recently been in a subsidy race—industrial policy by bureaucrats. The innovative forces of the market are being undermined and the inefficiency of these measures is predictable.

Socially Unjust Inflation: Why Recessions Are Inevitable and Salutary

Inflation is profoundly socially unjust. Its causes lie above all in an expansionary monetary policy, and this must be stopped. If policymakers want to prevent the inevitable recession that will follow, they will only make the problems worse.

The Inflation Problem: Short-, Medium- and Long-Term Solutions

In principle, it is the task of central banks to anticipate and combat inflationary risks. But since central banks failed to recognize inflationary pressures for a long time and then downplayed them as temporary, they can no longer contain inflation in a hurry. What solutions are feasible?

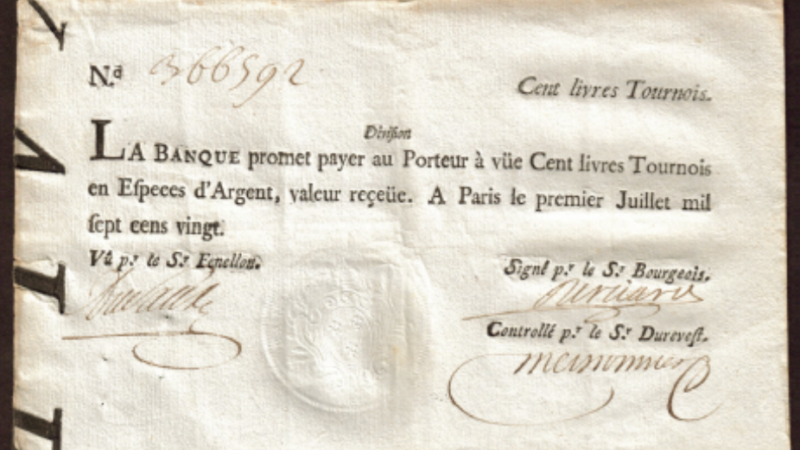

The Governments Were Financed Through by the Printing Press, And Now We Have Inflation

The rise in inflation does not fall from the sky. Inflation means general devaluation of money, not an increase in individual prices. It is the result of the money glut of the last several decades. Avoiding the dramatic consequences could make things uncomfortable.

Low Interest Rate Policy Cripples the Economy and Reduces Prosperity

Japan’s low interest rate policy began 30 years ago, about 15 years earlier than in the EU. But three decades of low interest rate policy meant three lost decades for Japan. In an interview with Stefan Beig, economist Gunther Schnabl explains why the low interest rate policy is so damaging to prosperity.

No More Growth—And Happiness Is Just Around The Corner

Critics of growth call for zero growth or even “degrowth”. Their fears are based on economic misconceptions and a failure to recognize the capitalist dynamic of decoupling growth from resource consumption. Moreover, they fail to recognize the needs of poor countries.

The Discovery of “Capital” in the Economic Ethics of the High Middle Ages

The pioneers of modern economics were moral theologians of the Middle Ages. Petrus Johannis Olivi discovered, among other things, “capital,” the subjective theory of value, and distinguished interest from usury. He thus paved the way for a positive view of commercial activity.