The Inflation Problem: Short-, Medium- and Long-Term Solutions

In principle, it is the task of central banks to anticipate and combat inflationary risks. But since central banks failed to recognize inflationary pressures for a long time and then downplayed them as temporary, they can no longer contain inflation in a hurry. What solutions are feasible?

Navigating Crises without a Compass: Politics in the Quicksand of Interventionism

Under the guise of the COVID-19 crisis, attempts are being made to use the crisis for a political agenda that would not have found majority support before. The role of the state is expanding. A new policy approach is necessary to secure prosperity.

Low Interest Rate Policy Cripples the Economy and Reduces Prosperity

Japan’s low interest rate policy began 30 years ago, about 15 years earlier than in the EU. But three decades of low interest rate policy meant three lost decades for Japan. In an interview with Stefan Beig, economist Gunther Schnabl explains why the low interest rate policy is so damaging to prosperity.

A New Era: Politicians and Central Banks Reinvent the Wishing-Table

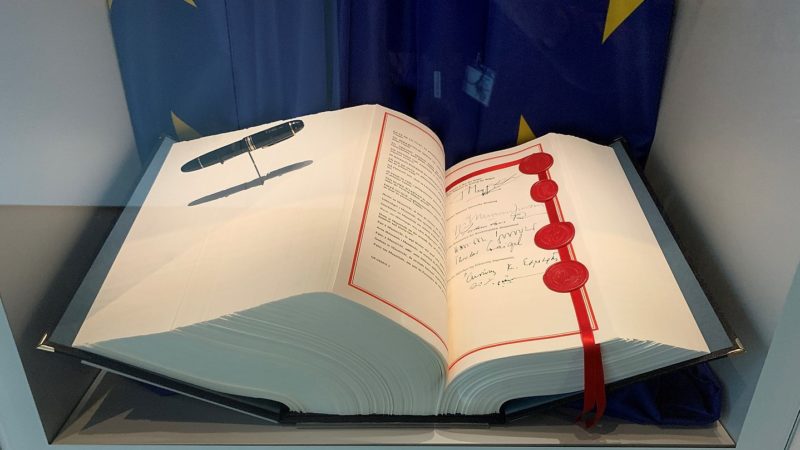

Unbelievable national debts and deficits, direct access of politicians to the printing press and unconditional payments to citizens in the USA. The EU, for its part, is embarking on the path of massive new national debt. Can this possibly end well?

Money Glut, Debt, and Rolling Central Bank Guarantees: Full Steam Ahead towards the Abyss

Central banks have become prisoners of their own policies with their perpetual monetary glut. Everyone knows this, and everyone knows that everyone knows it. But proclaiming a different message, they shirk responsibility. The party must go on at all costs.

The Bolivian Fairy Tale – The Illusory Success of “21st Century Socialism”

For years Bolivia was considered a successful example of the “Socialism of the 21st century”. An apparently booming economy blinded economists and politicians and obscured the view of a regime that was in reality authoritarian and corrupt.

For Eurozone Countries, the Problem Is Not So Much the Coronavirus, but Italy

The Italian people are hardworking, noble, and clever but held back by their own decadent institutions. With no end in sight, this mess hurts the entire European monetary union. It would be better for Italy and the other eurozone nations if Italy had an orderly departure from the euro.

The Coronavirus Crisis Shines Light on the Debt Spiral

The coronavirus crisis has exposed once again the fragility of our debt-based economic system. There are alternatives to this artificial system of the last 70 years. There are ways that we can better incentivize saving, which will create not only more productivity but more robustness.