Green Climate Policy: Moralism, Ideology and Dirigisme

The Greens are painting a picture of environmental and climate apocalypse. In this way, they try to moralize the debate and present themselves as the advocates of the good. On closer inspection, their program turns out to be ideological wishful thinking that eschews capitalism and the market economy.

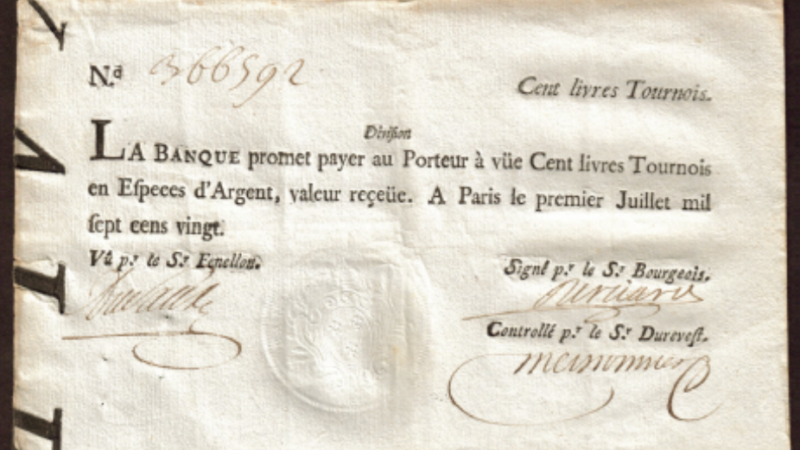

Private Currencies Terrify the Central Banks

Private currencies are currently making central banks sweat. The flood of paper money is making alternative private currencies increasingly attractive. They are based on a technology that is almost unassailable, and the central banks are reacting as you would expect.

Navigating Crises without a Compass: Politics in the Quicksand of Interventionism

Under the guise of the COVID-19 crisis, attempts are being made to use the crisis for a political agenda that would not have found majority support before. The role of the state is expanding. A new policy approach is necessary to secure prosperity.

The Universal Destination of Goods and Private Property: Is the right to private property only a “second-tier” natural right?

Did the rich get rich by robbing the poor? Theology and Catholic social teaching have long known that wealth generation is not a zero-sum game, but a process from which everyone benefits.

A Brave New World after the COVID-19 Crisis?

The Coronavirus pandemic is a golden age for critics of civilization, moralizers, miracle healers and intellectual crisis profiteers. At last, however, the economy and the market are being talked about in a positive light again—high time, because more than a few politicians are enjoying a permanent state of emergency.

Tax Policy “Harmonization”: Diversity Is Preached, Uniformity Is Practiced

From the OECD to the EU: Although people like to profess their support for diversity, they nevertheless insist on uniformity. The G-20 wants an international tax cartel. The pressure to be economical with taxes will diminish. The losers will be the citizens.

Low Interest Rate Policy Cripples the Economy and Reduces Prosperity

Japan’s low interest rate policy began 30 years ago, about 15 years earlier than in the EU. But three decades of low interest rate policy meant three lost decades for Japan. In an interview with Stefan Beig, economist Gunther Schnabl explains why the low interest rate policy is so damaging to prosperity.

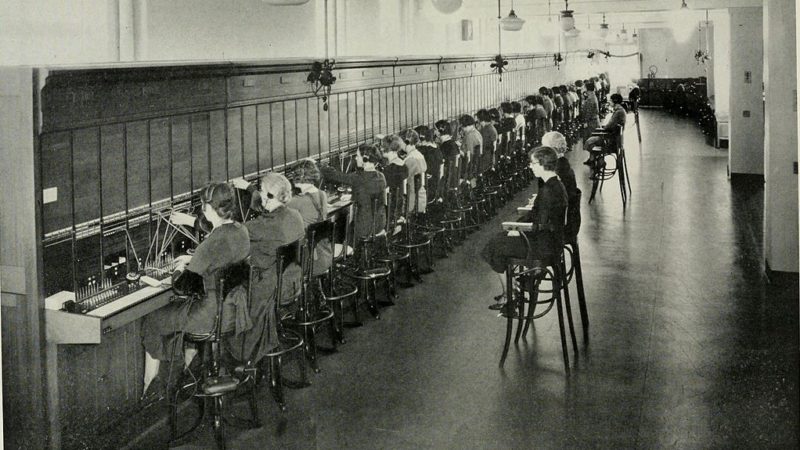

European Infrastructure and Tech Policy: Failures, Breakdowns, and Empty Promises

Compared to the USA, Europe is lagging behind in terms of information and communications infrastructure. A reexamination reveals: For too long, billions of taxpayers’ money have been invested in technologies of the past.

A New Era: Politicians and Central Banks Reinvent the Wishing-Table

Unbelievable national debts and deficits, direct access of politicians to the printing press and unconditional payments to citizens in the USA. The EU, for its part, is embarking on the path of massive new national debt. Can this possibly end well?