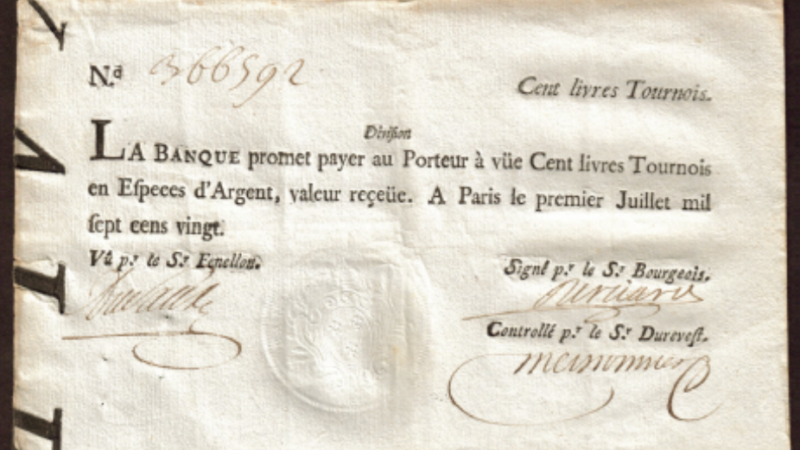

Private Currencies Terrify the Central Banks

Private currencies are currently making central banks sweat. The flood of paper money is making alternative private currencies increasingly attractive. They are based on a technology that is almost unassailable, and the central banks are reacting as you would expect.

Navigating Crises without a Compass: Politics in the Quicksand of Interventionism

Under the guise of the COVID-19 crisis, attempts are being made to use the crisis for a political agenda that would not have found majority support before. The role of the state is expanding. A new policy approach is necessary to secure prosperity.

Low Interest Rate Policy Cripples the Economy and Reduces Prosperity

Japan’s low interest rate policy began 30 years ago, about 15 years earlier than in the EU. But three decades of low interest rate policy meant three lost decades for Japan. In an interview with Stefan Beig, economist Gunther Schnabl explains why the low interest rate policy is so damaging to prosperity.

A New Era: Politicians and Central Banks Reinvent the Wishing-Table

Unbelievable national debts and deficits, direct access of politicians to the printing press and unconditional payments to citizens in the USA. The EU, for its part, is embarking on the path of massive new national debt. Can this possibly end well?

The Primacy of Politics and the “Other” Socialism

The “primacy of politics” over the logic of the economy is repeatedly and categorically demanded. Insofar as such efforts undermine the private property-based power of disposition over the means of production, it is the first step in the direction of the “other socialism.”

Money Glut, Debt, and Rolling Central Bank Guarantees: Full Steam Ahead towards the Abyss

Central banks have become prisoners of their own policies with their perpetual monetary glut. Everyone knows this, and everyone knows that everyone knows it. But proclaiming a different message, they shirk responsibility. The party must go on at all costs.

Our Superstate: Controlled by Party Headquarters, Bureaucracies—and Central Banks

A new book by Beat Kappeler shows that the separation of powers is being undermined, parliaments are being commanded by governments and bureaucracies, and the debt economy is being financed by central banks. The author also proposes remedies for these issues.

“Irrational Stock Exchanges” and the Wirecard Scandal: On the Blanket Suspicion of Financial Capitalism

Joint stock companies and stock exchanges have made the upswing of modern economies possible. However, they have always been suspected of serving the greed of a few. What, then, is the function of “financial capitalism”?