The Maastricht Treaty (1992), which introduced the European Monetary Union and the euro—Many pages that may soon only have museum value, as the treaty is under severe strain and threatens to become wastepaper due to the inflationary monetary policy of the ECB and unsustainable debt levels of the eurozone countries. (Image: Wikimedia Commons)]

The Maastricht Treaty (1992), which introduced the European Monetary Union and the euro—Many pages that may soon only have museum value, as the treaty is under severe strain and threatens to become wastepaper due to the inflationary monetary policy of the ECB and unsustainable debt levels of the eurozone countries. (Image: Wikimedia Commons)]

This paper can also be downloaded as a PDF file (Austrian Institute Paper No. 43/2022)

On July 21, 2022, the European Central Bank (ECB) introduced the so-called “Transmission Protection Instrument” to ensure that the ECB’s monetary policy is transmitted uniformly across the common currency area. Only in this way could the ECB fulfill its mandate of price stability. However, the program, originally announced as an “Anti-Fragmentation Instrument,” which joins other safeguard mechanisms with the acronyms OMT, PEPP, and TLTRO III, can also be seen as a new safety net for highly indebted euro countries. Thus, is it a “whatever it takes 2.0” that contradicts the ban on financing highly indebted euro countries as enshrined in Article 123 of the Treaty on the Functioning of the European Union (TFEU)?

A Monetary-Policy Balancing Act after Missed Inflation Forecasts

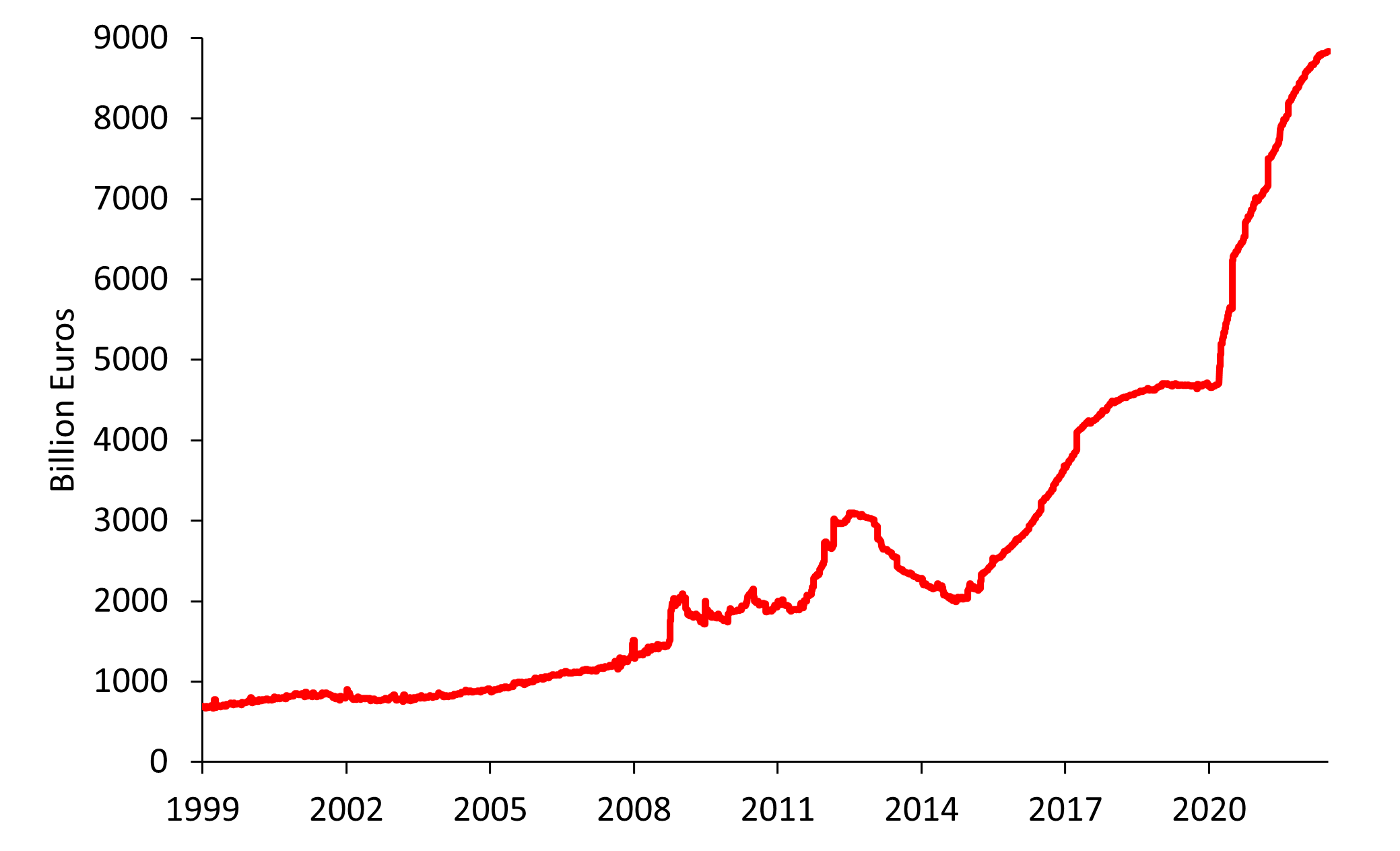

What is clear is that the ECB has crawled deep into a thicket. Not least due to its persistently loose monetary policy, which is reflected in a greatly swollen central bank balance sheet (Figure 1): inflation shot up to 9,1 % in August 2022, far above the 2% target it had set itself. ECB President Christine Lagarde’s assurances that inflation would be temporary have proven false. Time and again, the ECB has had to revise its inflation forecasts upward, severely damaging its credibility. Most recently, it was forced to raise key interest rates by 0.5 percentage points instead of 0.25. Without a simultaneous announcement of the Transmission Protection Instrument, the ECB would probably have risked a breakup of the euro.

A closer look at the latest monetary policy decisions reveals a balancing act. On the one hand, high inflation has made it unavoidable to announce a turnaround in monetary policy. After all, according to Article 127 TFEU, the ECB’s primary objective remains price stability. On the other hand, the bankruptcy of some highly indebted euro countries such as Greece, Italy, and even France is imminent, which is why the ECB has left many loopholes open in the way it has signaled monetary policy tightening, unlike the U.S. central bank, the Fed. It wants to proceed gradually with the normalization of monetary policy, to make decisions dependent on data, and to remain flexible.

Figure 1: The Size of the Eurosystem Balance Sheet

It is true that the ECB was anchored in the European treaties along the lines of the Deutsche Bundesbank. Based on the Stability and Growth Pact, the so-called Maastricht criteria were supposed to limit government debt to shield the ECB from pressure by highly indebted euro countries to buy their government bonds. However, the criteria were gradually weakened from the very beginning through exemptions and disregard. Above all, crises served as justifications for exceptions that increasingly became the rule. Since the Coronavirus crisis and with the Ukraine crisis, the debt limits have been suspended for all countries. At 96%, the average government debt in the euro area is far above the Maastricht limit of 60%. In France, prominent politicians are already openly considering an end to the Stability and Growth Pact.

The ECB has also gradually changed its instruments (Schnabl and Sepp 2021). Sharp interest rate cuts in response to the bursting of the dotcom bubble and the associated high money supply growth encouraged exaggerations on the real estate markets of some southern euro area countries and Ireland beginning in 2003. The ECB saw no reason to take countermeasures because the original reference value for money supply growth was suspended in 2003. In addition, the European statistics authority Eurostat—in contrast to other countries—does not take owner-occupied residential property prices into account when measuring inflation. This led to the European financial crisis, which justified permanent interest rate cuts to and below zero.

Euro Crisis: The Monetary Union Reveals Itself as Unstable and Ill-Conceived

As the cost of bailing out southern European banks drove up sovereign debt during the financial crisis, the European debt crisis (euro crisis) ensued. Mario Draghi’s promise to save the euro (“whatever it takes”) involved making extensive government bond purchases the norm in monetary policy. Initially, the ECB only bought the bonds of crisis countries, then of all eurozone countries, proportionally aligned with the countries’ share of the ECB’s capital. The ECB continued to buy bonds even during the economic recovery between 2015 and 2019. Longer-term refinancing loans were disproportionately granted to the banks and companies in the southern euro area to stabilize them.

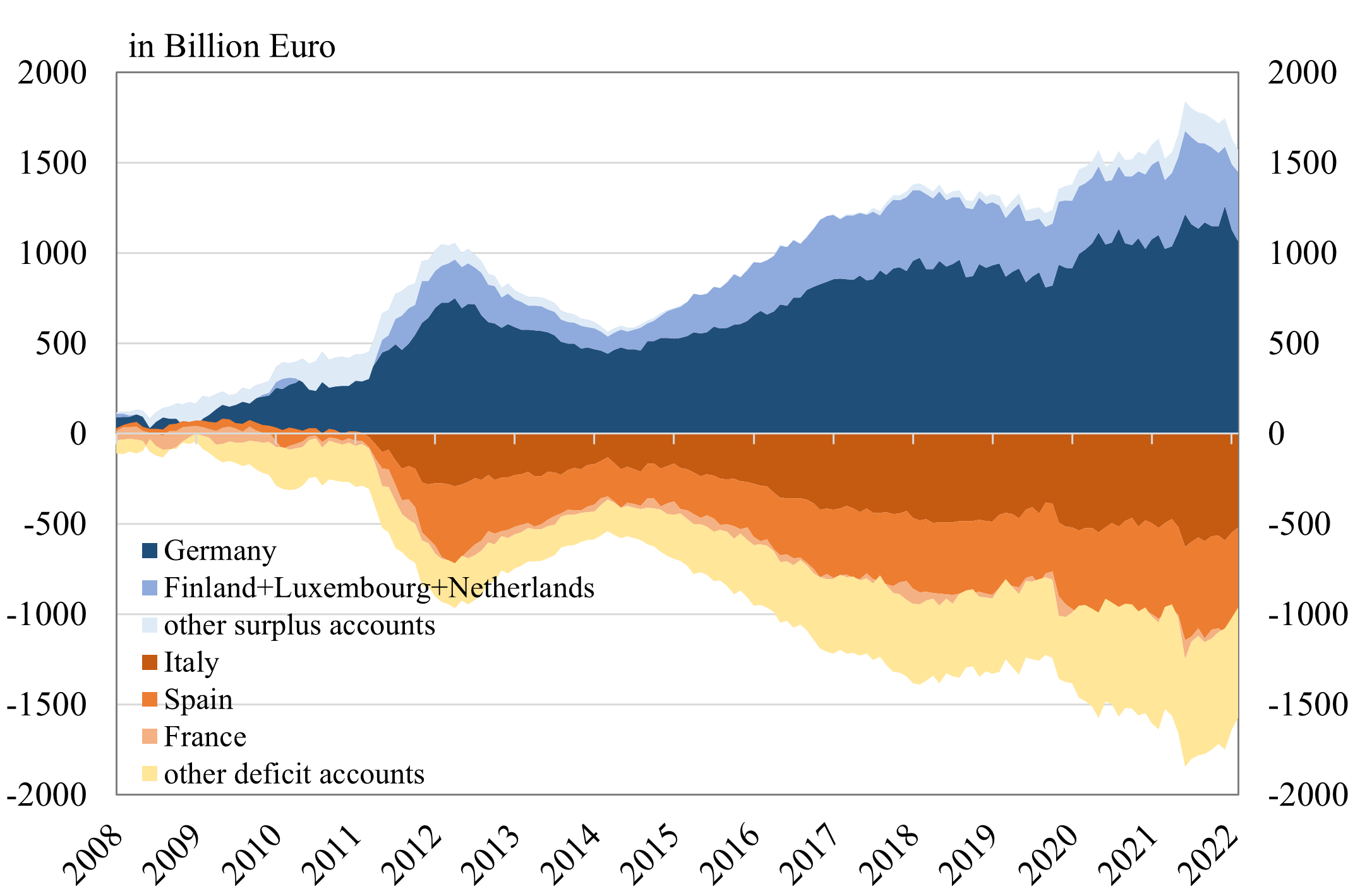

The Eurosystem’s TARGET2 payment system developed into a cross-country credit mechanism in which the Deutsche Bundesbank currently holds claims amounting to almost €1.2 trillion (see Figure 2). The liabilities of the central banks of Italy and Spain are correspondingly large. Unlike other lending mechanisms, there are no conditions for lending, no upper limits on liabilities, and no repayment deadlines. The interest rate on TARGET2 liabilities was 0% until the last monetary policy decision in July 2022. Now it is 0.5%, far below the interest rate on long-term government bonds issued by creditor countries.

Figure 2: TARGET2 balances of the Eurosystem

This reveals cracks in a monetary union that was unstable and ill-conceived from the outset. Unlike the USA, the European Monetary Union does not have a common fiscal and social policy that can mitigate different economic developments via transfers from state to state. Moreover, northern and southern Europe have followed different economic cycles from the beginning, which were exacerbated by largely independent fiscal policies. The ECB thus inevitably set the wrong interest rate for most countries, resulting in economic and social dislocations (Müller and Schnabl 2017).

The Development of the EU into a Treaty-Sensitive Debt Union

After all, the excesses in the southern euro area between 2003 and 2007 were also triggered by the fact that, since the turn of the millennium, Germany had been trying to comply with the Maastricht stability criteria by cutting government spending and restraining wage settlements. As savings therefore rose and investment fell, German banks transported the excess capital to southern Europe and Ireland. There, the cheap loans fueled consumption and speculation on the real estate markets. When tax revenues rose because of the boom, the southern euro states fueled the excesses even further with higher government spending.

After the outbreak of the European financial and debt crisis, the trend was the opposite. Governments in the crisis-ridden south were pressured by the European Commission to save, while the ECB’s zero interest rate policy drove up real estate prices in Germany. The German government abetted the exaggerations by bringing the now soaring tax revenues to the people while proudly pointing to a balanced budget. The imminent bursting of the German real estate bubble in the wake of the Coronavirus crisis was probably prevented by the ECB’s hastily adopted Pandemic Emergency Purchase Program worth €1.85 trillion.

Although the Coronavirus crisis and the Ukraine war have hit all euro countries, the hope that all countries would now be in the same boat has not borne out. The significantly more indebted South is said to have a strong interest in communitizing its debts. Since there have always been transfers from North to South since the beginning of the European integration process in the 1950s, there is a strong expectation that these will continue.

These expectations were further reinforced by the more than €1 trillion Next Generation EU Fund, launched in 2021 under pressure from the Coronavirus shock. Since it is unrealistic in the long run to have larger allocations for southern Europe from tax revenues from northern countries, they are likely to be feasible only with the help of the ECB. Either the ECB buys bonds from the EU, which then transfers the money to the south, or the ECB buys the bonds of the southern European countries directly. Both are tricky from the perspective of the European treaties. Now, with the recently announced Transmission Protection Program, the direct bond purchases seem to be the case, even though the Eurosystem’s balance sheet has already grown from just under €700 billion in 1999 to almost €9 trillion (Figure 1).

Loose Monetary Policy: Damage to Growth, Unfair Distributional Effects, and the Subsidization of Large Corporations.

However, the problem is that continued loose monetary policy is damaging growth. As the ECB has increasingly lowered the cost of financing for companies, these companies no longer have an incentive to increase efficiency. This is also true for the German economy, which before the euro was under constant pressure to become leaner and better due to steady appreciation of the Deutschmark. The ECB’s longer-term refinancing operations, currently worth more than €2 trillion, have kept sluggish companies in the southern euro zone afloat, but they have also prevented necessary restructuring. At the same time, the rampant regulations often emanating from the EU, including ambitious climate protection, are further reducing productivity, so that the struggle for remaining prosperity has become more intense.

In addition, there are negative distribution effects of monetary policy. The ECB’s persistently loose monetary policy has driven up the prices of shares and real estate, which are predominantly in the hands of wealthy people. By contrast, the savings deposits of the middle class no longer earn interest. Due to declining productivity gains, the wages of broad segments of the population have been under pressure for years. Inflation, which is now rising sharply, is accelerating the devaluation of savings and the decline in purchasing power. While the preservation of the euro is thus increasingly in conflict with social justice in Europe, left-wing parties see the growing inequality as an opportunity to raise their profile by calling for more redistribution.

Furthermore, the ECB has subsidized large export-oriented companies by buying their bonds for a long time and devaluing the euro. Large companies may have also benefited more from the additional spending leeway that the ECB has created for governments. This is because large companies can more easily politically influence decisions on subsidy payments. By contrast, many small and medium-sized companies are suffering from rampant regulation and the declining purchasing power of the middle class.

With the Loss of the Deutschmark, the Golden Goose Was Slaughtered—and the Euro Threatens to Fail Europe

During the European financial crisis, then-Chancellor Angela Merkel defended the euro rescue as having no alternative, saying, “If the euro fails, Europe fails.” Now it is becoming apparent that since the introduction of the euro, the rifts have become ever deeper and the need for reform ever greater. The strong Deutschmark combined with the free movement of goods, services, labor, and capital within the European community of states was once the backbone of prosperity in Europe. Acceptance of European integration was high. For a long time, the high productivity gains in Germany were the basis for wage increases, the expansion of the welfare state, and the financing of the common European institutions.

Now it seems that with the loss of the Deutschmark, the golden goose has been slaughtered. Growing distribution conflicts at the national level—as is now clearly visible in France and Italy, for example—and the intra-European level—as created by TARGET2 balances and growing desires for communitization of high national debts—are endangering cohesion in Europe and thus the European integration project. Soon, Germany could find itself alongside an Italy led by extreme parties in a monetary union on its way to becoming a transfer union.

It remains to be seen whether the ECB’s loud rhetoric about a climate rescue and gender justice can mask these major differences both among euro countries and within each individual euro country. With the younger generation in Europe particularly suffering from high housing prices, low wages and high inflation, a reorientation of the common monetary policy is urgent. A good way forward would be a return to stability-oriented monetary policy along with disciplined fiscal policies and comprehensive deregulation. Companies, nations, and banks would be forced to reform, which would put Europe back on the growth path. But within the ECB, it is likely to be difficult to achieve political agreement to reorient monetary policy toward the goal of price stability.

A Proposal: A German Parallel Currency as an Anchor and Driver of Competition

In this case, a new independent central bank in Germany could issue a parallel currency that could be backed by infrastructure (see also Mayer and Schnabl 2020). If this path were supplemented with structural reforms, the new German currency would appreciate against the euro, and inflation would be curbed. If the new currency became the anchor currency for some smaller northern and eastern European countries, significant seigniorage gains would accrue to the new central bank.

This path would reestablish the monetary competition in Europe that once sustained prosperity and freedom in Europe before the euro, together with the four freedoms of the single market—free movement of goods, capital, service and people. German industry would be forced to make efficiency gains that would help put social security systems back on a sounder economic footing. Growing purchasing power among northern and eastern European citizens would also stimulate the economy via more imports from the south. Young people in Europe could once again look forward to a brighter future.

Literature:

Mayer, Thomas / Schnabl, Gunther. “Post-COVID-19 EMU: Economic Distancing by Parallel Currencies.” Intereconomics 55,6, (2020): 387-391.

Müller, Sebastian / Schnabl, Gunther, “Zur Zukunft der Europäischen Union aus ordnungspolitischer Perspektive.” ORDO 68 (2020): 3-34.

Schnabl, Gunther / Sepp, Tim, “Inflationsziel und Inflationsmessung in der Eurozone im Wandel.” Wirtschaftsdienst 101, 8, (2021): 615-620.

Translation from German by Thomas and Kira Howes.