Is Planet Earth bursting at the seams? That may be how the notorious growth skeptics see it, but they are not taking into account technological progress and the increasing decoupling of growth from resource consumption that comes with it. (Image: Sergey Nivens/Shotshop.com)

Is Planet Earth bursting at the seams? That may be how the notorious growth skeptics see it, but they are not taking into account technological progress and the increasing decoupling of growth from resource consumption that comes with it. (Image: Sergey Nivens/Shotshop.com)

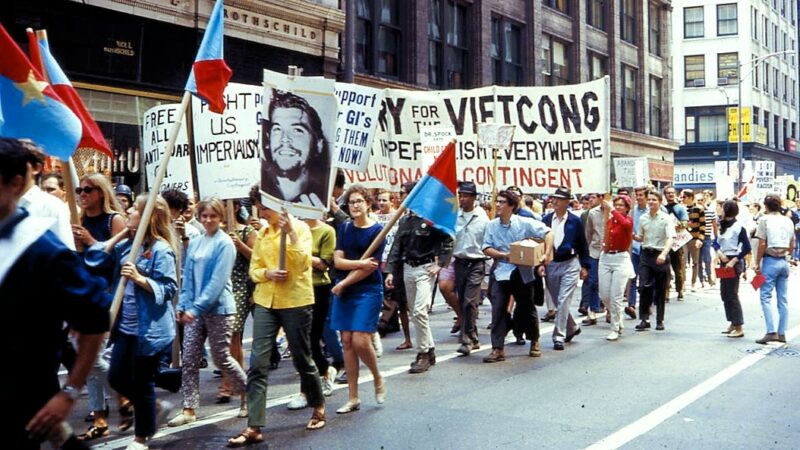

The movement that advocates “degrowth”—zero or even negative growth, in French “décroissance” —has for a long while been gaining momentum in many rich countries, but not so much in Brazilian favelas or Indian peasant villages. But let us leave aside the polemics and first turn to a popular source of this thinking, and then we will consider the economic and social facts.

The studies conducted by the Club of Rome remain quite popular, and they are often quoted in popular science, but they are hardly ever compared to one another. After all, in 1972— The Limits to Growth —the Club alerted the world that there would soon be no more oil, lead, or copper to supply perpetual growth. The input side of the world society would fall away. This has not played out. The warnings that followed, on the other hand, lamented the effects of CO2 emissions for the climate—so then it became the output side that was unbearable.

Shortsightedness reigns supreme when the politics of the day takes hold of the long term. After the tsunami that hit the nuclear power plant in Fukushima, this source of electricity was cancelled, with nuclear power in general falling out of favor. But shortly thereafter, the climate issue came back into focus at the Paris conference, and since then, no electricity expenditure is considered too high to eliminate oil and promote geothermal energy or electromobility.

A Growth Imperative? Transformations of an Old Theory

But let us set aside the politics of the day. Basically, the movement for zero growth assumes that environmental problems accrue roughly in proportion to economic growth, i.e., they become more threatening as the economy grows. To save the environment, growth must therefore be stopped.

First of all, growth: it is an inevitable force of the market and capitalist society. This thesis runs through many theories since Marx, at one point with Klaus Traube (Wachstum oder Askese? [“Growth or Asceticism”], 1979), today, exactly forty years later, for example, with Mathias Binswanger (Der Wachstumszwang [“The Growth Imperative”], 2019). From time immemorial, many have also thought that interest demands eternal growth from the economy, without which it could not exist.

Drawing conclusions about the economy as a whole based on the growth of individual firms is therefore by no means compelling. Time and again, companies go bankrupt, go out of business, or switch to other activities.

Thus, Binswanger also ties the imperative back to (among other things) the loans granted to companies—they must earn interest from more production. In general, however, the competition, renewal, and expansion of investments would force the companies to “more and more.” However, this claimed interest trap—as the popular saying goes—fails to recognize the possibility of simply paying interest from other profit and income sharing, without additional revenue. Moreover, many entrepreneurs do business without borrowing continuously. Then, too, the “rat-race” to size and market dominance takes place only in the competition between the big companies, hardly in the medium-sized company part of the economy, in trade and services, and which has much more volume.

Drawing conclusions about the economy as a whole based on the growth of individual firms is therefore by no means compelling. Time and again, companies go bankrupt, go out of business, or switch to other activities. The average growth rate is not the annual 12 percent or more that young analysts tell ageing CEOs to expect. Binswanger’s theory is based on eleven equations with almost the same number of variables—but at this level of abstraction, nothing is really accurate anymore.

Questionable Growth Statistics

The way in which growth is defined and measured today provides better insights. In the gross national product, the statisticians of all countries count—or rather estimate—what goes over the counter for money. But many criticize the fact that voluntary work and housework are not taken into account. These are, after all, an important source in the increase in growth figures. For two hundred years, more and more of the same services have no longer been provided at home but “over the counter,” i.e., they have entered the formal economy.

In the past, during a lockdown, the elderly would have spun their yarns in the parlor; today, people buy these tales for money on Netflix. In Sweden, almost all women are fully employed, but with school, in after-school programs, caregiving, walking dogs, and providing social care for pay, they now contribute—with what used to be “produced” as common housekeeping—to a part of the national economy. Bookkeeping, gardening, cleaning, coaching, consulting work, everything goes this way, with women as with men. Municipalities everywhere are being merged, and volunteer work that used to be small-scale is now professionalized and paid for. And every civil servant is simply entered into the statistics with his or her salary—and, lo and behold, once again the domestic product increases.

Somewhat less generally, however, a stock market index like the Dow Jones also shows how nondefinitive measurements of “growth” are. People like to criticize how the line on the graph has almost gone vertical in exponential growth. But today there are 30 companies in it, but since its beginning, about 100 companies have been replaced. Even last August, the oil giant Exxon fell out because it has become less important. If it completely bottoms out thanks to “green politics,” however, the index will not show this substantial loss of a previous economy—and that means that it only shows the positive side of growth, the net balance would be a completely different, more modest one.

Unquantifiable Technological Progress

The aforementioned streaming company Netflix can also illustrate another aspect of this: The “growing part” of economies relies on a good deal of information technology. This is highly valued by the market because of statistical sales—Netflix with 230 billion—but there is much less real capital and resources tied up than, for example, in the Italian steelworks company Ilva (formerly Gioia Tauro) in Taranto, which has been running a deficit for decades, hardly produces at all, causes enormous environmental damage, and keeps its 20,000 workers going with short-time pay.

Technological progress is often overlooked, because it is usually not quantifiable and therefore referred to as a “black box.” For 250 years, technology has increased per capita output, labor productivity and—mostly—capital productivity. With the same amount of effort, therefore, there is more output, more growth. But this is now more often reflected in information technology, services, and unquantifiable convenience, rather than in tons of steel produced. What unbelievable progress the Internet, and then the mobile phone, have brought, and just so many conveniences for life! Markets have become transparent for companies and more rational. Everyone has access to the knowledge of the world. After the first overseas cables were installed, the leading gentlemen of the major banks gathered in the boardroom to listen to the stock market data from London; today, every GameStop trader has it on his or her own cell phone. Everyone can readily access what Nobel Prize winners have written; a meeting gets cancelled, and everyone knows it before having left their homes. Trips can be planned right down to even inspecting the hotel room. This growth of the national economy “inwards” is simply accepted—it is real, but it does not show up in the figures.

The Decoupling of Growth and Resource Consumption

But if a successful programmer of electron heaps now sits down in his Porsche in the evening, he creates a climate problem: the output of the national economy puts a burden on the environment. This is then the second aspect that critics have in mind—and rightly so: the problem of the Porsche and not IT or its reflection in the abstract growth figures.

In fact, much of the former growth came from rising labor and capital productivity using disproportionately more environmental resources—energy and land, in addition to generating noise. Resource efficiency declined. Is that still the case today? If not, then even a “growth imperative,” if it exists, would not be a problem. The consumption of resources per unit would then already decrease, and will continue to decrease.

Since growth is difficult to measure and can only be inadequately extrapolated from individual company profits to the economy as a whole, it is better to look at the “footprint” of this growth in real terms. In this context, we should bear in mind the view of an old master of “steady-state growth,” Nicholas Georgescu-Roegen, that in a finite ecosystem, the economy cannot grow indefinitely—but that is only, as we see it today, if it devours resources in the same proportion.

For a long time, however, politicians have not recognized the problems any better or any sooner, so they had better not provide a “permanent remedy.” They should not offer solutions, only procedures.

But the decoupling of growth and resource input—or rather, resource output—is already taking place and will continue steadily. Environmental goods must be internalized into the cost considerations of companies, households, and the state. CO2 permits, which must be bought at auction, serve this purpose. In extreme cases, direct bans, such as those on hydrofluorocarbons or methane emitters, can also serve this purpose. Sacred cows must also be addressed, such as the actual cows of meat-intensive agriculture, the enormous methane-producing waste dumps of California, a state which hypocritically only addresses the issue of gasoline cars. But here, too, we can hope for technical progress: Genetic engineering and agrotechnology have already substantially reduced methane emissions from cows in New Zealand, and research is in full swing.

A decoupling of growth and resource consumption thanks to technical innovations also appears on the horizon today, for example, when solar and wind generated hydrogen can take over most of the energy input. Georgescu-Roegen clearly argued based on the assumption of a petroleum economy, Klaus Traube with nuclear power in mind, others simply “because of growth” alone.

The Treacherous “We”

But that “we” of green politics is treacherous: only political decisions could cause such changes of power. For a long time, however, politicians have not recognized the problems any better or any sooner, so they had better not provide a “permanent remedy.” They should not offer solutions, only procedures. With internalizations of externalities, on the other hand, the initiative is left to the individual companies and households, so they can determine a path along the technical learning curve situationally and individually.

Also treacherous among growth critics are the presumptions, especially those about how much “the people” should consume. Asceticism from a knowing hand is the order of the day. And Mathias Binswanger even knows that all growth today goes to “bullshit jobs.” Thus, he knows better how the lowly masses should labor differently—as seen from the ivory tower of academia.

Translation from German by Thomas and Kira Howes