In Pope Francis’ Encyclical Laudato si’ and at many other times, Vatican documents have criticised markets, financialisation and speculation. Some of these criticisms have implied that speculation in food markets is damaging to the interests of the poor. However, there is no evidence for this and, indeed, the opposite is likely to be the case. Certainly any minimal damage that arises from food speculation is hugely outweighed by the damage to food markets caused by bad government policy.

The general situation – poverty and inequality

Before I talk about whether commodity price speculation can promote the common good or whether it is part of the “economy that kills”, it is worth noting that the so-called “economy that kills” is responsible for the most rapid reduction in child mortality and increase in life expectation that the planet has ever known.

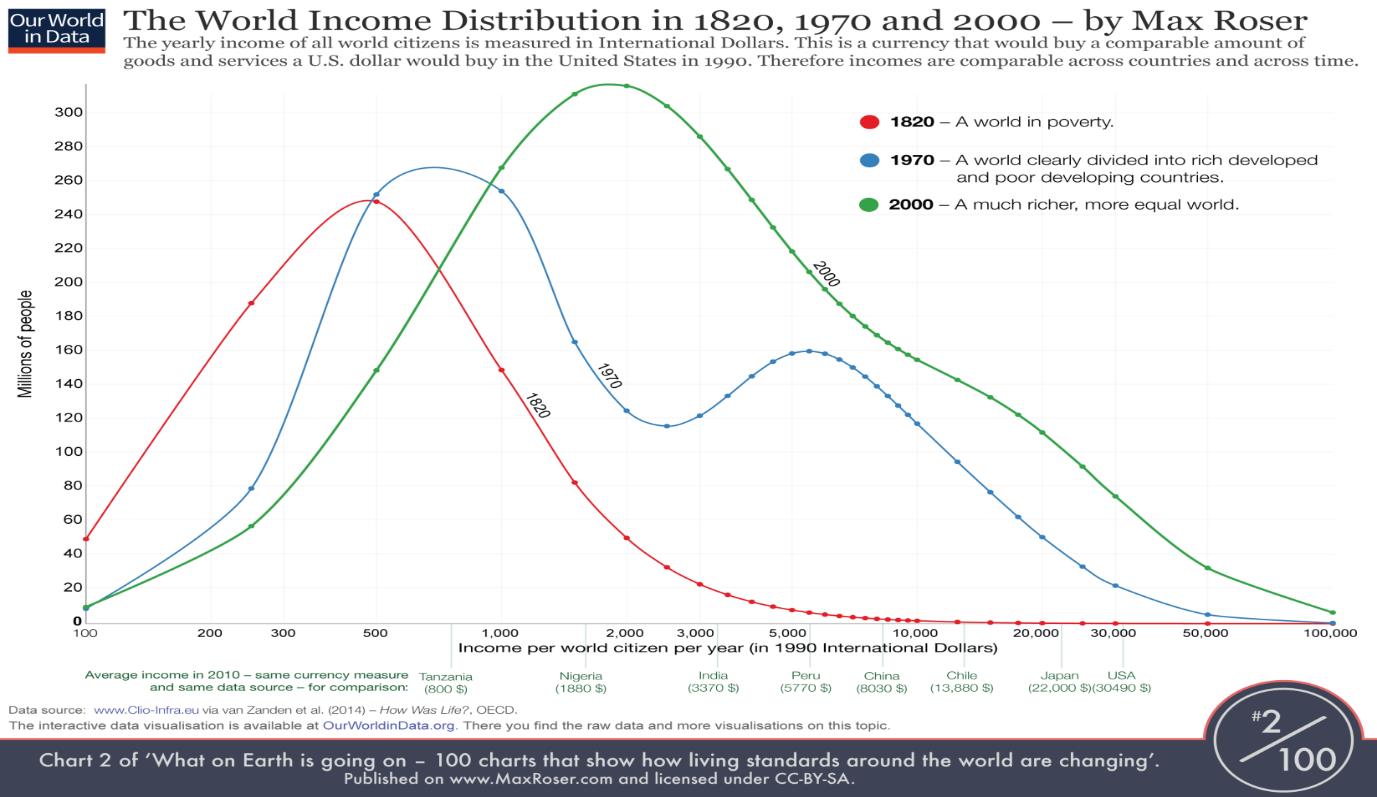

As barriers to trade have fallen since 1980, the proportion of the world’s population that lives in absolute poverty has fallen from 45 per cent to 10 per cent. Life expectation has risen from 68 to 76 years in Vietnam, 44 to 64 in Ethiopia and 53 to 61in Ghana. The world has never known economic progress for the poor at this rate before. During the last decades, world inequality has fallen too, as is show by the following chart:

This shows how, in 1970 (the blue line), the world was clearly divided into two distinct parts (three if you count the communist world as a separate entity – hence the phrase “third world” for the poor countries). Today, the world’s income distribution is shown by the green line which shows a much more even distribution of income. We really do have one world. There are, of course, some very rich people around, but the vast majority of the world’s population now has enough to live on and a little more. Poverty and inequality have fallen together and fallen substantially.

Food prices, trade and speculation

One of the reasons for the fall in inequality and poverty is the growth of free trade which has linked a large number of previously very poor countries to global markets. Free trade can reduce food price volatility (because food prices are less susceptible to harvest failure in a given country when people have access to world markets). However, globalisation has not just led to free trade in goods and services but also to a huge increase in cross-border finance. This can be linked to speculation on commodities and it raises the questions I have been asked to address.

In general, I will refer to speculation as it relates to food. The same principles apply to other commodities. However, food is more important, partly because we cannot live without it, but also because, unlike with other commodities, poor people are always participants in food markets either as buyers, sellers or (very often) both.

Pope Francis’ statements on speculation and food prices

Catholic social teaching should take the issue of food prices and their volatility seriously. Indeed, it was by Pope Francis in his address to the United Nations Food and Agriculture Organization, in 2015. He said:

beginning in 2008 the trend of food prices has changed: doubled, then stabilized, but always with higher figures in comparison to the preceding period.

He linked this to speculation, saying:

[H]ow does the market and its rules affect world hunger?… we cannot overlook financial speculation: for example the high prices of wheat, rice, corn, soy, which fluctuate on the stock market, perhaps they are linked to profits and, therefore, the higher the price the greater the profit.

As it happens, higher food prices on average do, in fact, benefit the poorest people in the world because poor people tend to be net sellers of food; in fact, this very point was made in Populorum progressio. An academic paper of the International Food Policy Research Institute concluded about the huge increase in food prices in 2005-2010: “the recent increase in global food prices has significantly accelerated the rate of global poverty reduction”.

But, I am more interested in the problem of speculation. It is, in fact, difficult to think of any plausible mechanism by which prices can be driven ever-higher by speculation motivated by the desire for more profit. When things are traded, including commodities, there are two sides to the trade. One side benefits from the price going up and the other side benefits from the price going down. There is no net gain from prices going up as far as the speculators are concerned, just a different distribution of gains between the different types of speculators. Indeed, in the UK, an Anglican Bishop strongly criticised speculation in banking shares for driving their prices down.

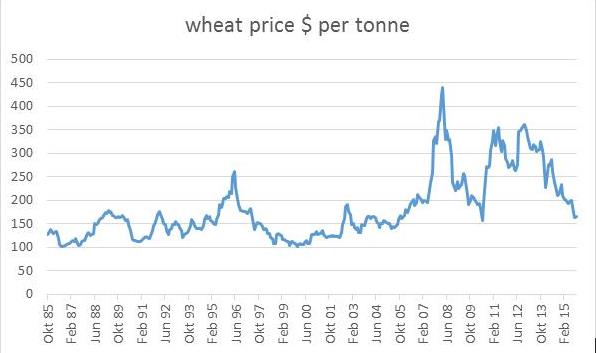

It is not just at the level of theory that it is difficult to see how prices can be driven ever-higher by speculation, the empirical evidence confirms this. This graph shows wheat prices since 1985:

The wheat price today is more or less the same price in nominal dollars as it was in 2009, 2005, 1995 and 1985. And this makes no allowance for general price inflation either. In real terms food prices have fallen for a long time despite rising populations. If you look at other foodstuffs as well as other basic commodities you find the same trend. It is simply factually incorrect to say that their prices always stabilise at higher levels.

There is, though, a separate and important question of whether speculation might lead to more volatility in commodity prices. This, in turn, might create pinch points where people, in particular situations, are unable to access food. To think about this question, we need to go into a bit more detail about speculation.

Buying and selling commodities we do not own

- Futures for hedging

Let us start by thinking of a situation where a farmer and a food processor might buy and sell commodities they do not have for their own protection. This is known as hedging. If you are a farmer producing cocoa, you might wish to sell your produce at a fixed price before the harvest is in because the costs have to be borne before the crop is produced. It is a form of insurance. In the same way, a processor might wish to buy their cocoa at a price that is fixed in advance of the crop being produced in order that they can develop their marketing strategy fix price lists, and so on.

For these reasons, simple forward contracts can develop. They exist in all sorts of markets and have existed since ancient times. However, if we leave it to farmers and processors to simply make arrangements between themselves, there are several disadvantages. There will be relatively few buyers and sellers of the contracts; both will be locked into contracts which might not turn out to be appropriate as situations change; the contracts will probably be expensive; and so on. As a result of this, financial markets – called futures markets – develop that allow buying and selling of forward interests.

- From hedging to trading

Once such futures are developed, it is difficult to prevent all sorts of people buying and selling them even if they are not farmers, processors or others who have an important interest in insuring themselves against volatility in food prices. So, then you get what is perceived to be the problem of investors, traders and speculators buying commodity futures.

Does this cause problems in food and other commodity markets? Again, we can think about this problem from the point of view of theory and empirical evidence. And this is where it gets complicated. I will do my best to explain.

Let us assume that people expect a rise in the price of wheat by (say) 50 per cent over six months and the current price is 100. Let’s assume the commodity is wheat. There is a futures contract available that allows you to agree today a price at which you will buy a tonne of wheat in six months’ time. Given that we expect the wheat price to be 150 in six months’ time, it is highly likely that the futures contract will settle on a price of around 150. Assume a hedge fund buys that contract. In practice, what happens is that, in six months’ time the hedge fund pays 150 and receives an amount of money equal to the price of a tonne of wheat. In fact, the contract is designed, of course, so that the holder receives the difference between the price of a tonne of wheat and 150. The buyer – or speculator – gains from any increase in the price of wheat. At this level, the arrangement is really unconnected to the market for wheat. There is no mechanism (as yet) between the futures speculation and the actual price of wheat.

- Speculation in commodities futures

Now let’s assume there is speculation in the futures contract and everybody wants to buy it for some reason. Let’s say that the futures contract now rises in price to 200. This means that, in six months, the buyer receives the difference between the price of a tonne of wheat and 200. If the price of wheat does not rise to 200 within six months those who have bought the future will make a loss and those who have sold it will make a profit.

Can this speculation affect the wheat price?

There are various ways in which the price of wheat can react to and follow the price of the future – in other words, there are ways in which speculation can drive up prices. For example, traders could somehow corner the market in the underlying product – wheat – and withdraw the product from the market in order to keep the price up so that they make profits on their futures contracts. In some circumstances this would be illegal, but it is, in fact, pretty much impossible in relation to nearly all commodities and there is no real evidence of it ever happening. In general, futures traders never have access to the underlying product.

Secondly, the speculation in the futures market might somehow affect decisions to produce wheat thus driving up the price of the underlying commodity. However, the opposite is likely to happen. If farmers see that the futures price is high, it gives them an opportunity to lock in a high price for their produce today. They might be able to plant today (though this will depend on the nature of the commodity), and use the futures market to guarantee them the high price. But, this should bring forward food production more quickly than would otherwise happen.

Lastly, and this is most complicated, farmers might store their wheat when the futures price is higher than the current price. Most futures markets are in storable commodities and some – such as metal ores – can be stored indefinitely. If a farmer sees that the six month wheat futures price is 200, he might sell the future and put the wheat in storage. Thus, by selling the future and putting the wheat in storage, he has guaranteed himself a price of 200 and taken the wheat off the market for the duration of the contract. It would be sold again at a time when it was expected that the commodity would be even more scarce. If anything, the use of the futures market and the withdrawing of the produce from the market for a time is helpful, rather than harmful, in relieving scarcity.

If there are people going hungry at the time, this might be thought a bad thing. And it is just possible to envisage a mechanism where it might cause problems in some circumstances. However, in general, the effect is benign. The farmer doing exactly what happens in the bible – storing in years of relative plenty in order to sell it when there is a shortage. The futures market simply helps him to do that.

Summing up

Even these simple examples might seem rather complicated and one could go on forever making up examples that get more and more complex. The general message is that financial speculation in commodities is likely to have the following effects. It will:

- Make it easier for relatively poor farmers to get information about prices

- Make it easier and cheaper for relatively poor farmers to manage their own risk

- Leave relatively poor farmers less exposed to price changes

And it could have the following effects:

- Bring forward increases in production in times of shortage

- Facilitate storage in times of surplus

- It might reduce supply in times of shortage and therefore increase volatility

But, is there any evidence for the last effect? As an article in the Journal of Agricultural and Applied Economics by Martin T. Bohl and Patrick M. Stephan puts it, in theory, feedback effects are possible; in practice, no empirical proof has been found. Studies show that in recent years, storage levels for soft commodities did not increase as prices rose. The levels stayed steady, or even dropped. Furthermore, studies have suggested that there is no effect of financialization on volatility either. In fact, price volatility in commodities where there are no futures markets (such as and tungsten) has, in recent years, increased more than volatility in commodities where there are futures markets.

Conclusion

The view I have expressed is clearly not the view of Pope Francis. Also, it is not the view of the campaign group, Global Justice Now which linked high food prices directly to speculation, arguing that speculation: “pushes up global food prices, leaving millions going hungry and facing deeper poverty”. This body is strongly linked to local Catholic Churches and various ecclesial communities. But, I am afraid that its views are simply wrong.

But, simply unravelling a myth about speculation is not really very satisfying. I would like to persuade you that something positive can be done. High food prices in the late 2000s were caused by a number of factors. These included: higher prices for inputs such as fertiliser and oil; widespread wheat harvest failures; maize being used for fuel due to the misguided policies mainly of the US government; and the imposition of export controls on rice and huge government hoarding of rice by many countries, especially India and the Philippines, was (according to Will Martin and Kym Anderson from the World Bank) responsible for an incredible 45 per cent of the increase in world rice prices in 2006-2008. In individual countries policy in relation to food markets is often terrible. In Indonesia, government intervention in both trade and domestic markets mean that the domestic rice price is 60 per cent above the world price whilst one-seventh of the population live on less than $1.90 a day. In India, around 50 per cent of all food produce rots before it reaches markets because of internal transport and distribution problems mainly relating to tariffs, internal customs points and regulation of the retail industry.

If the Church wishes to really understand why so many people go hungry then she really needs to understand how real markets are prevented from working on the ground in difficult conditions in poor countries rather than focusing our attention on financial markets that are easy to study and yet barely affect food prices.

In his Encyclical Laudato sí, Francis commented: “In the meantime, economic powers continue to justify the current global system where priority tends to be given to speculation and the pursuit of financial gain…”.

I am not quite sure what this means. In the OECD 92 per cent of all economic activity takes place outside the financial sector. And even most financial sector activity has nothing to do with speculation. India has more poor people than any country in the world and, as I have said, 50 per cent of all food in India rots before reaching the market. Blaming commodity speculation for the fact that the poor cannot afford basic commodities is like the police choosing to investigate the murder of somebody who has been strangled by interviewing anybody in the town who owns a gun.

This is the unpublished text of a paper read at the conference In Dialogue With Laudato Si’: Can Free Markets Help Us Care For Our Common Home?, organized by the Acton Institute (Grand Rapids, USA) at the Pontifical University of the Holy Cross in Rome, December 3, 2015.

Image: Sao Paulo, Brazil, June 19, 2004. BM&F, commodities exchange futures, Stock Brokers Trading in Sao Paulo, Brazil (by Alf Ribeiro / Shutterstock.com)