Not only in the business world our decisions depend on many factors. Yet how do we know what is relevant, when and why? (Picture: Khakimullin/Shotshop.com)

Not only in the business world our decisions depend on many factors. Yet how do we know what is relevant, when and why? (Picture: Khakimullin/Shotshop.com) This September marked the 75th anniversary of what is perhaps F.A. Hayek’s most influential and well-known essay, “The Use of Knowledge in Society.” In it, Hayek draws attention to the fact that the most relevant knowledge for economic decision-making is not the general knowledge of the economist or philosopher, but rather the dispersed, local, and often tacit knowledge of myriad individuals in an economy. Although his primary concern is to show the irresolvable problems of central planning, his insights in this and other related essays have many implications and applications, both within and beyond the field of economics.

The full version of this article including notes and references is available as Austrian Institute Paper (No. 34/2020).

Download of the PDF here

Mathematical Models and Real Economies

Hayek begins “The Use of Knowledge in Society” by sharing some of the same concerns he had in “Economics and Knowledge” (1937), an essay in which he notes a tendency of certain economists to ignore the economic problem of knowledge because perfect knowledge is already assumed in their models. More specifically, they are working with mathematical models of ‘perfect equilibrium’—the market clearing price at which there are no shortages or wasteful surpluses—with assumptions of perfect knowledge and perfect competition. Such economists tend to ignore the problem of knowledge in the real world, which is never perfect, and thus miss the more interesting question of precisely how markets ever tend toward equilibrium in the first place.

Most of the economically relevant information, such as the relative importance of various economic ends in the minds of individuals, are known only to those same individuals.

The problem of market coordination is more obvious if one considers Hayek’s point that most of the economically relevant information, such as the relative importance of various economic ends in the minds of individuals, are known only to those same individuals, and very often, Hayek later implies, tacitly. The economic problem, according to Hayek, is thus how to use this knowledge. He believes this has been neglected by economists who model their methods on the natural sciences: a methodological criticism Hayek presents in various places.

Dispersed and Tacit Knowledge

Hayek states that virtually everyone has some advantage of knowledge over everyone else because of the knowledge unique to one’s vantagepoint of “time and place.” For some jobs, one receives formal training, learning the basic concepts relevant to the job. But in almost every job, Hayek adds, there is much that one must learn on the job.

This is worth examining closer. To carry out one’s job it is often the case that one must become familiar with one’s environment, one’s craft (know-how); one must sometimes even develop skill in applying conceptual tools (intellectual know-how), as well as job-related familiarity with other persons, either those with whom one must work or, more importantly, customers. Although within a firm, for instance, there is both formal and informal communication of such information, much of the economically relevant knowledge remains at any given time or sometimes indefinitely as tacit or inarticulate. And even when such tacit knowledge is made partly explicit it will always include a tacit element.

There are many examples of such tacit knowledge in daily life. You might, for instance, be asked for directions to a certain restaurant, only to realize that while you could easily drive there without any difficulty, you still cannot successfully give directions to someone else. As Michael Polanyi says, “we know more than we can tell.”

Unlike knowledge of mere facts, knowledge by familiarity—e.g. familiarity of persons, places, concepts, etc.—always features at least a tacit component.

In Personal Knowledge, Polanyi points out how little most swimmers know about what makes them float, or how little bicyclists know about what they are doing to keep balance. He also discusses the skill of perception acquired by medical diagnosticians. Medical technicians, for instance, are trained to perceive objects in an x-ray or sonogram that might appear only as random shapes to laypersons. Such technicians have likely learned to see the objects spontaneously, without needing to consciously consider the clues upon which they rely for such perceptions. These are all examples of what is called know-how and it can range from know-how in more physical activities to the intellectual know-how of a scientist or theoretician.

Know-how is a certain type of knowledge by familiarity. Unlike knowledge of mere facts, knowledge by familiarity—e.g. familiarity of persons, places, concepts, etc.—always features at least a tacit component, no matter how thoroughly one discusses the things about which one is familiar. For instance, if you were asked to describe one of your parents, when you finished speaking it would be unlikely you have expressed everything you know about your parent—in fact there is much about them you do not yet know how to put into words, even if you had the time.

Similarly, we must rely on a tacit sense of tradeoffs in our daily purchases. And it is the same for managers of the company, who develop over time, and with the aid of much explicit knowledge, a sort of familiarity with their craft, with their plant, and with their customers. With such matters in the background, a good manager will make decisions for the company based on his or her best judgment. Entrepreneurs will similarly look for opportunities in the market based on a good deal of background knowledge they have of the industry or of consumer preferences.

Hayek’s concept of dispersed or localized knowledge is not the same as inarticulate or tacit knowledge, but his account of dispersed knowledge nonetheless implies that it is often tacit, and thus the two concepts are naturally complementary. Some dispersed knowledge is already explicit in the minds of those who possess it, and inarticulate knowledge can often be made explicit at varying costs of time and mental energy. However, articulation of tacit knowledge is sometimes beyond the ability of the one who possesses it, or other times it only becomes explicit to oneself when one encounters a situation, problem, or question that relates to it. Articulation is an achievement, sometimes relatively easy, other times quite difficult, as the history of philosophy shows.

Economic Decision-Making in a Dynamic Economy

Let us now return to Hayek’s essay, where he proceeds to elucidate the dynamic nature of an economy and what effect this has for decision-making within it. It is understandable, he says, that some economists think that a modern economy is much more static than premodern economies, given their preference for static models and statistical aggregates. But that is an illusion. Underlying such aggregates is a dynamic process of constant change.

The ivory tower economist need only spend a few weeks with the manager of a business to see that adjustments are constantly being made to adapt to changes in the company, to keep costs down in the midst of competitive pressures and constantly changing relative prices, and to adapt products to consumer preferences. Thus, the economic problem “is mainly one of rapid adaptation to changes in the particular circumstances of time and place…” But if the relevant information for making such rapid adaptation is most often knowledge possessed only in dispersed and often tacit form, then it is clear to Hayek that such decisions must be left to those with the relevant localized knowledge.

Let us step back again to evaluate Hayek’s point. Even if we only considered local knowledge that can be easily transmitted in an articulate form, and even beyond the prohibitive costs of communicating such knowledge—not Hayek’s concern in this essay—the sheer quantity of this information, on any given day, would be far too much for any one planner or planning group to use. Moreover, much of the information is based in the tacit sense of individual agents, a tacit sense grounded in familiarity with the realities most relevant for achieving the company’s goals.

To further complicate things, judgments about the relative importance that certain goods and services have in relation to substitute goods and services is likely to only be known to such dispersed economic agents when they are forced to make economizing decisions related to those goods and services. For example, Bob, manager at the automobile plant, might more easily and happily find a substitute for steel screws than would Carl at the cabinet factory. Yet it is likely that both Bob and Carl would only recognize these relative preferences when confronted with a decision that concerns them.

That is, in the very act of deciding—and, we can add, having the benefit of prices as a measure—they learn something about their own evaluations of the relative utility of these goods. The relative value that either Bob or Carl places on steel screws in relation to substitutes, and precisely what each considers a true substitute, is the sort of information an idealized central planner would want to possess. Yet, that is not the sort of information Bob and Carl could just write down in advance. For a planner to possess such information for all the myriad individuals in an economy is, of course, impossible.

The Problem of Coordination

At this point, we see how only decentralized decision-making can utilize the most economically relevant knowledge. But without a central planner, how would economic activity be coordinated? How could decentralized decision-makers be expected to coordinate among themselves in an efficient manner? Is this not just another knowledge problem, just as prohibitive as the one Hayek has highlighted?

Rational coordination is made possible by the price system, a price system only possible, by the way, in a system of decentralized decision-making.

The answer Hayek gives, following his mentor Ludwig von Mises, is that rational coordination is made possible by the price system, a price system only possible, by the way, in a system of decentralized decision-making: it both depends on decentralized economic decision-making for its emergence, and it makes coordination possible for that same decentralized system.

Given the complex interrelated phenomena of an economy and its relationship to the complex world in which it is situated, Hayek notes that “there is hardly anything that happens anywhere in the world that might not have an effect on the decision [that the economic agent] ought to make.” But that does not mean that each such individual needs to know everything about the various factors that affect his or her decision:

It does not matter for him why at the particular moment more screws of one size than of another are wanted, why paper bags are more readily available than canvas bags, or why skilled labor, or particular machine tools, have for the moment become more difficult to obtain.

Hayek gives a helpful example of what would happen if something caused a spike in the price of tin. Most people in an economy would not need to know what caused the spike, and this, he says, is crucial, for otherwise we would run into another knowledge problem.

We can draw out the general implications of his point without following his example to the letter—and please forgive my ignorance about these industries. Companies that mine tin might want more information about the cause of the price spike to see if it would be worth it to make longer-term investments, for instance, in mining equipment or mines. Similarly, producers of mining equipment would likely find that information relevant for the same reason. Others in the mining industry with less interest in long-term investments in tin but plenty of short-term flexibility to shift resources to tin and back when things change might not need to know the cause of the spike. In either case, such decisions to shift resources toward mining tin would eventually increase the supply of tin, limiting or eliminating shortages, and would thus put downward pressure on its price.

Producers of other goods with production process involving tin might consider the possibility of substitutes, some ultimately opting for substitutes, others not, depending upon their specific circumstances and preferences. Firms switching to substitutes would in turn put downward pressure on the price of tin and upward pressure on the price of those substitutes, and this would also put upward pressure on substitutes to the substitutes, if the price increase in the former led to more purchases of the latter. At the level of ordinary consumers, those who would otherwise consume tin, or purchase products whose prices were affected by tin’s increased price, might also opt for substitutes. And again, those doing this would put upward pressure on the price of those substitutes. The choice of consumers to economize tin would contribute to the avoidance of shortages and would also put downward pressure on the price.

Economic agents, responding only to price signals, tend to adjust purchasing, production, and investment behavior in a way approaching the counsel of an ideal central planner.

The overwhelming majority of economic agents in this scenario need no further knowledge about tin than the fact that its price has increased. As Hayek explains, the whole market acts in a unified fashion without any individuals or groups knowing the whole market but because different spheres of the economy “sufficiently overlap so that through many intermediaries the relevant information is communicated to all.” Thus, economic agents, responding only to price signals, tend to adjust purchasing, production, and investment behavior in a way approaching the counsel of an ideal central planner, limiting the problems of both shortages and wasteful surpluses—with surpluses indicating a use of labor and capital that would have been better used on other things.

Is the market perfectly efficient? No, but perfect efficiency is unattainable. What is important is that the market is far more efficient than any other option. We can share Hayek’s “marvel” that it accomplishes what it does. How could humanity have happened upon such a system that no human mind could have ever designed? And yet, as Hayek points out, it is precisely because it is not a product of human design that so many have been tempted to replace it with a better “plan.” Hayek dedicates a section of this essay to highlighting the price system as an example of an evolved ‘spontaneous order’—terminology he borrows from Michael Polanyi— which is an order that emerges without any conscious human design. This idea of spontaneous order would be a major theme in Hayek’s work from the 1940s on.

Complementary Developments

It is worth briefly mentioning another aspect of the market economy that makes possible greater use and transmission of knowledge—competition. Hayek discusses this in “The Meaning of Competition” (1946) and “Competition as a Discovery Procedure” (1968, Eng. 2002). As regards competition, Hayek’s emphasis on knowledge is complementary to economic analysis in terms of incentives.

Competition is also a ‘discovery procedure’ that promotes the acquisition and greater use of economically valuable knowledge.

Certainly, through the incentive of profit and loss, competition motivates businesses to better meet the preferences of customers and at a lower price than competitors. Those who succeed at meeting customer preferences for both quality and price will generally win out. But viewed from Hayek’s ‘epistemic’ lens, competition is also a ‘discovery procedure’ that promotes the acquisition and greater use of economically valuable knowledge. Consider how Henry Ford’s production methods, first leading to the remarkable success of Ford Motor Company, were then imitated by competitors, thus driving down the price of cars even further and making the whole economy wealthier.

Hayek’s notions of dispersed, localized knowledge and the implied, complementary notion of tacit knowledge have numerous applications outside Hayek’s initial use of them. (See, for instance, the many applications of these ideas in Thomas Sowell’s Knowledge and Decisions (1980), a book for which Hayek gave a glowing review). Here, I will briefly show how these notions can be applied to one significant contemporary policy issue: school choice.

Contemporary Application—School Choice

‘School choice’ refers to a set of policy proposals aimed at giving parents more choice with respect to their children’s education. Such policies include freedom to homeschool or enroll students in private school, freedom to enroll in other geographical districts (‘open enrollment’), the establishment of charter schools, and the granting of school vouchers (and various alternatives). There are important ethical arguments for such proposals, for instance, based on the harm certain government policies have on the relationship between parents and their children, by divesting parents of responsibilities that are significant to that relationship. There are also important arguments, going back to Milton Friedman’s 1955 essay “The Role of Government in Education,” that such ‘school choice’ policies represent a superior institutional process. This type of argument can be supplemented by Hayek’s insights concerning the discovery, use and transmission of knowledge.

A very strong argument for school vouchers, going back to Friedman, relies on the concepts of incentives and competition. According to this argument, it would be better if the government took the same tax money allotted for a child to be spent on public schools and gave it back to parents in the form of a voucher to spend on alternative means of education. Such a solution would better align incentives and bring with it the benefit of competition. Parents can be more reliably expected to use this allotted funding in such a way that favors the educational interests of their children. Moreover, this would force schools to compete for the parents’ interests. This would not create competition where there was none. Rather it would make it so that competition was more between schools, competing for the approval of parents, and less parents competing with the interests of unions, administrators and bureaucracies.

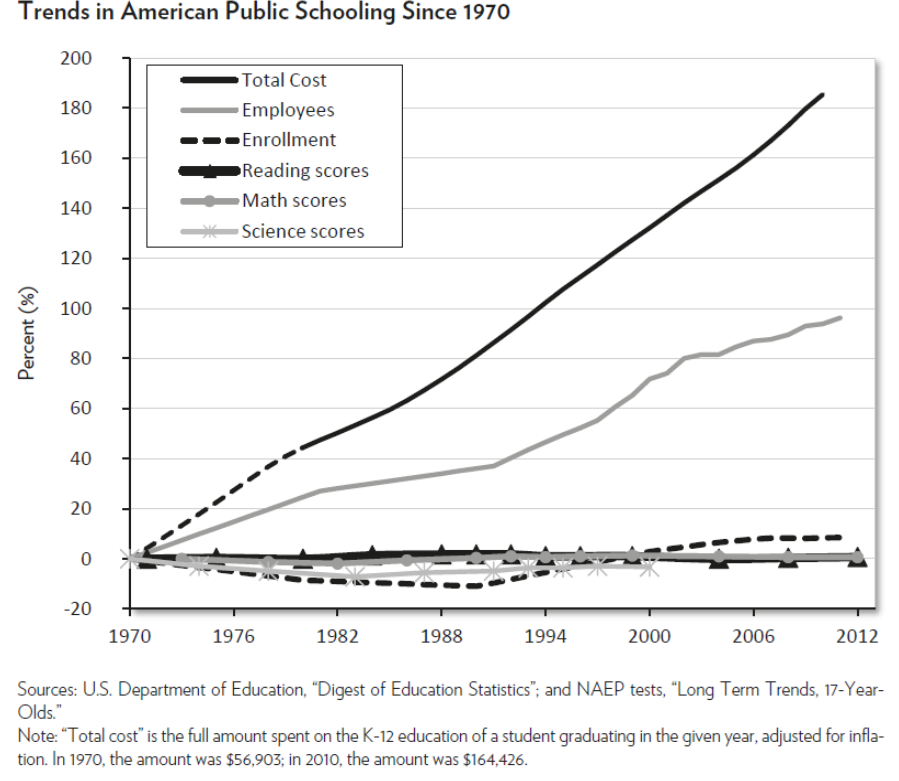

In a competitive environment, schools will either improve or perish, and those schools that survive will do so because they have better met the preferences of parents for the education of their children. In the United States, public money spent on primary and secondary education more than doubled in the last forty years on a per pupil basis. All the while, public school performance has not improved significantly by any of the available testing metrics. To paraphrase Friedman, it is clear we have been subsidizing institutions rather than people, or as Corey DeAngelis puts it, systems rather than students.

Hayek’s analysis in terms of the use and transmission of knowledge is also relevant here. A better institutional process for education involves the use and transmission of relevant knowledge. Parents can reliably be expected to have privileged knowledge about their own children and their specific needs. Who could deny this? Divesting parents of responsibility for the education of their children allows much of this privileged knowledge to go to waste (and this same principle applies to teachers in relation to administrators, bureaucrats, or politicians).

With school choice, creative solutions will arise, and the solutions that work best will have a competitive advantage.

Certainly, most parents are not experts on education, but they are adults who generally—exceptions treated as such—can be relied upon to care about their children’s education and have a general sense of whether their children are receiving a quality education. Moreover, ‘a rising tide lifts all boats’: if some parents are better than others at recognizing the quality of their child’s education, providing important feedback—the transmission of knowledge—especially in how they spend their educational funds, then this will improve the quality of education for all students. Julian Le Grand, in The Other Invisible Hand (ch. 3), highlights evidence that school choice, done right, not only improves the education of students in general, it even improves the performance of public schools, who now have to compete with, and learn from, competitors.

With school choice, creative solutions will arise, and the solutions that work best will have a competitive advantage. As Corey A. DeAngelis points out, if you gave parents vouchers representing the $15,000+ dollars spent per pupil on public education in the United States, a teacher could presumably start a micro-school of 10 students, pulling in $150,000+ in revenue. I do not know if this would be the ideal model for most children, but it gives us an idea of the range of possibilities. We will learn what works better though the ‘discovery procedure’ that is competition—a kind of education itself, now in the service of education.

Conclusion

With respect to the implications and applications of these Hayekian insights, I have only scratched the surface. “The Use of Knowledge in Society” contains a concise presentation of certain key aspects of Hayek’s contribution to political economy and other types of institutional analysis. This essay of Hayek’s develops on his earlier lecture/essay “Economics and Knowledge,” and is later complemented by his essays “The Meaning of Competition” and “Competition as a Discovery Procedure.” Together these essays capture the core of Hayek’s treatment of the systemic discovery, use, and transmission of knowledge. And, on this the 75th anniversary of Hayek’s pivotal essay, they are ideas worth celebrating.